Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Nordic Capital acquires Tokmanni from CapMan

Nordic Capital has acquired Finnish discount retailer Tokmanni Group from CapMan.

Italian GPs ask: Why Not Italy?

Why not Italy?

Gimv invests £5.7m in series-B round for Prosonix

Gimv has committed ТЃ5.7m to the second closing of a series-B financing round, now totalling ТЃ17.1m, for UK-based pharma Prosonix.

LDC-backed Avelo acquires TrigoldCrystal

LDC portfolio company Avelo has completed the strategic acquisition of London-based mortgage solutions provider TrigoldCrystal.

Carlyle backs Avail-TVN with $100m for On Demand acquisition

The Carlyle Group has provided $100m in growth capital to US video provider Avail-TVN to acquire UK-based On Demand Group.

Nauta subscribes to €4.5m Yuilop round

Nauta Capital has participated in a €4.5m series-A funding round for portfolio company Yuilop, a Spanish smartphone software developer.

CVC reduces stake in F1 prior to IPO

CVC Capital Partners has sold a $1.6bn stake in Formula 1 Group to BlackRock, Waddell & Reed and Norges Bank Investment Management prior to the company's IPO, according to reports.

unquote" British Private Equity Awards

The 2012 unquote" British Private Equity Awards will be held in London on Thursday, 4th October.

notonthehighstreet.com receives £10m series-D funding

Fidelity Growth Partners Europe (FGPE) has joined previous investors Index Ventures and Greylock Partners in a ТЃ10m funding round for UK online business notonthehighstreet.com.

Ingenious expands corporate finance team

Ingenious Media has recruited new corporate financiers David Brooks and Toby Ramsden, who will join as managing directors.

DFJ Esprit appoints Peter Keen as venture partner

DFJ Esprit has hired Peter Keen as a new venture partner, specialising in medical technology and life science investments.

David Rolfe joins NVM Private Equity

David Rolfe has been appointed as investment partner for the South of England at NVM Private Equity.

£70m restaurant bill could generate 2x for Caird

Caird Capital may be about to exit its minority stake in restaurants chain D&D London.

FSI Régions and Alliance Entreprendre invest in Fabulous Garden

FSI Régions and Alliance Entreprendre have injected €1m into French outdoor furnishings company Fabulous Garden.

LP interview: Alpha Associates' Petra Salesny

LP Interview

Montagu's Host Europe buys Mesh Digital

Montagu-owned Host Europe Group (HEG), a London-based web hosting business, has acquired domain registration services provider Mesh Digital.

CBPE buys minority stake in IVF clinic

CBPE Capital has bought a minority stake in London-based Assisted Reproduction & Gynaecology Centre (ARGC).

FSI Régions backs Arcancil Paris MBO

FSI Régions has invested €500,000 in the management buyout of Arcancil Paris.

France unquote" May 2012

As reported in the last issue of unquote” analysis, French deal-doers had reason to cheer in 2011.

LDC buys Ocean Outdoor from Smedvig

LDC has completed the ТЃ35m buyout of UK digital advertising firm Ocean Outdoor from Smedvig Capital.

Simon Borrows steps in as 3i CEO

3i Group has officially appointed Simon Borrows as CEO, taking over from Michael Queen with immediate effect.

Swiss PE market threatened by regulatory reform

Regulation to hit Swiss PE market

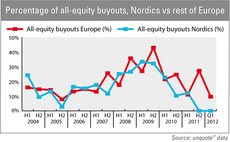

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

DACH unquote" May 2012

Germany has recently reformed its insolvency law with the introduction of ESUG, the Act for Further Facilitation of the Reorganisation of Enterprises, which promises to make it easier for businesses to get out of administration and back on their feet....