Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

HTGF invests in AudioCure Pharma

High-Tech Gründerfonds (HTGF) and business angel Dr Schumacher have provided German drugs candidate developer AudioCure Pharma with seed funding.

Comecer acquires Brita Trade

Fondo Italiano portfolio company Comecer has acquired Brita Trade, a Czech glass processing firm.

Sator backs Extrabanca

Sator private equity has made an initial €15m investment in independent bank Extrabanca, securing a 38.9% stake.

Vienna bourse set for IPO comeback

It has been a tough few years for Vienna’s stock exchange but an ambitious new CEO and several planned private equity IPOs over the next two years could see the bourse become attractive again to private equity. Carmen Reichman reports

Seventure injects €2m into Netino

Seventure Partners has invested €2m in French online content moderation platform Netino.

Sentica acquires Silta

Sentica Partners has taken a majority stake in payroll consultancy Silta.

Finance Wales backs QPC with £2.3m

Finance Wales has invested ТЃ2.3m in Welsh information technology company QPC.

Inveready leads €1.5m round for Wineissocial

Inveready has led a series-A funding round of more than €1.5m for Spanish wine e-tail and recommendation site Wineissocial.

Idinvest et al. back Sensee with €17.5m

Idinvest Partners, Partech International, Orkos Capital and several business angels have provided French online optician Sensee with a €17.5m funding round.

Fondations Capital grabs 60% of Sepur

Fondations Capital has acquired a 60% stake in French waste collector Sepur from its founder, in a deal that values the business at €124m.

Bain Capital sells FCI division for €765m

Bain Capital Europe has sold the motorised vehicles division of FCI, an automotive and electronics connector company, to NYSE-listed Delphi for €765m on a cash and debt-free basis.

DC Advisory appoints executive director

Corporate finance firm DC Advisory Partners has appointed Jack Dessay as executive director in its European Technology, Media and Telecommunications (TMT) team, based in London.

Terra Firma denies plans to float Infinis (update)

Terra Firma has met banks to discuss a potential ТЃ1bn IPO for its energy portfolio company Infinis.

De Persgroep Netherlands acquires 80% of PE-backed VNU Media

The Dutch arm of Belgian media company De Persgroep has acquired an 80% stake in Netherlands-based VNU Media, which is jointly held by 3i and HIG Capital.

Terra Firma head of IR quits

Terra Firmaтs head of investor relations Kamal Tabet has left the firm after only 11 months.

CVC-backed Evonik announces IPO

CVC Capital Partners-backed German chemicals maker, Evonik Industries, has confirmed plans to float in the Prime Standard segment of the Frankfurt stock exchange.

Scandinavian banks downgraded by Moody's

Moody's has downgraded some of the most popular private equity debt providers in Scandinavia.

Viking Venture exits myVR

Viking Venture has exited Norwegian software company myVR to Swedish trade player Hexagon.

Tax authority demands Nordic Capital execs repay SEK 412m

Nordic Capital executives have been ordered to repay SEK 412m in carried interest tax, after the Swedish tax authority reached a final verdict in a lengthy investigation.

Rutland Partners' Notemachine completes £63m refinancing

GE Capital, Barclays and European Capital have provided a ТЃ63m senior debt refinancing package for Rutland Partners' UK portfolio company Notemachine.

French LBOs top European performance tables, says AFIC

LBOs generated higher returns in France than in all other European countries in 2011, although their performance declined year-on-year, according to a recent study by private equity association AFIC.

Norway joins carried interest tax push

The Norwegian tax authority will classify carried interest as standard income, putting a few hundred million NOK of carried interest at risk.

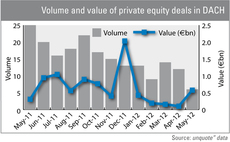

DACH investment leaps forward in May

Investment in the DACH region surged forward in May, with seven deals worth an estimated €580m, compared to 12 deals worth just €100m in April.

Equistone in €1bn Global Blue exit

Equistone Partners Europe (formerly Barclays Private Equity) has sold travel payment service provider Global Blue to Silver Lake Partners and Partners Group in a €1bn deal.