Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Milestone reaps 6x money on Cadum trade sale

Milestone Capital has reaped around 6x its money on the sale of French soap and baby products company Cadum to L’Oreal.

Langholm acquires Purity Soft Drinks in MBI

Langholm Capital has backed Gary Nield and Peter Unsworthтs management buy-in of Purity Soft Drinks from long-time owners the Cox family.

UK government sells remaining stake in Actis

Emerging markets investor Actis has bought the remaining 40% shareholding held in the company by the UK government for ТЃ8m.

Video: Pantheon's Hadass talks fund selection

Nowadays current portfolio performance is a strong gauge of future fund performance. Kimberly Romaine interviews Pantheon's Leon Hadass.

Lion Capital buys Alain Afflelou

Lion Capital has entered exclusive talks to acquire French eyewear retailer Alain Afflelou from Bridgepoint, Apax France and Altamir Amboise in a deal believed to be valued at nearly €800m.

Doughty Hanson acquires Grupo Hospitalario Quirón

Doughty Hanson has agreed to acquire a stake of around 40% in Spanish hospital group Grupo Hospitalario Quirón from current owners the Cordón Muro family, who will retain the remaining shares.

Altius adds to infrastructure team

Altius Associates has appointed Reyno Norval to the global infrastructure and real assets team in London.

Permira eyeing Nokia luxury phones

Permira is looking to pick up luxury phone manufacturing business Vertu from Nokia, reports suggest.

Caird Capital exits Bifold to LDC for £85m

Caird Capital has exited gas pumps manufacturer Bifold Group to LDC in a ТЃ85m deal yielding a 3x return for the seller, according to a source close to the deal.

Palamon concludes £23m refinancing of Cambridge Education Group

Palamon Capital Partners has completed a ТЃ23m refinancing deal for its portfolio company Cambridge Education Group (CEG) with Royal Bank of Scotland.

Vitruvian leads $64m round for Just-Eat

Vitruvian Partners has led a $64m funding round for London-based online takeaway ordering service Just-Eat.

JPEL extends credit facility with Lloyds TSB

JP Morgan Private Equity Ltd (JPEL) has extended a $150m multi-currency credit facility with Lloyds TSB Corporate Markets.

Vesalius Biocapital leads €2.7m financing round for Trinean

Vesalius Biocapital, Capital-E, Baekeland II Fund and Fidimec have invested €2.7m in Belgian biotechnology business Trinean.

Terra Firma buys Four Seasons for £825m

Terra Firma has acquired British elderly and specialist care provider Four Seasons for ТЃ825m.

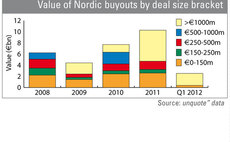

Nordics see strongest first quarter since Lehman

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordics has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees.

ISIS appoints four partners

ISIS Equity Partners has promoted Pete Clarke, Liz Jones, Paul Morris, and Daniel Smith to partner.

Reiten & Co exits Ellipse Klinikken

Reiten & Co Capital Partners has exited cosmetic treatments provider Ellipse Klinikken to Swedish private clinic chain Akademikliniken.

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.

ISIS closes fifth fund on £360m

ISIS Equity Partners has closed its fifth vehicle ISIS V on ТЃ360m.

Accell Group buys Perseus's Raleigh Cycle for $100m

Perseus Capital and Raleigh Cycle's management have sold the British bicycle business for $100m to Dutch trade player Accell.

HTGF invests in futalis

High-Tech Gründerfonds has provided German dog food business futalis with seed financing of €500,000.

McDermott hires Dewey & Leboeuf duo

Law firm McDermott Will & Emery has officially appointed Mark Davis and Russell Van Praagh as partners in the firm's London offices.

French turnarounds suffer from narrow GP base

As in most European countries, one could have thought that the morose economic environment would be a boon for French turnaround specialists.

Vendis Capital invests in Yarrah Organic Petfood

Vendis Capital has backed Dutch organic pet food producer Yarrah Organic Petfood.