Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

GP Profile: Greenpeak Partners on emerging manager fundraising and specialisation

Buy-and-build specialist looks for portfolio add-ons as it contemplates hitting the road for a new fund in 2023

Summa opens North American office

Three existing partners will lead the California office, which is the GPтs first beyond Europe

Pinova expects final close for Fund 3 before year-end

DACH industrial technology and IT investor has set a EUR 250m target for the vehicle

Foreign GPs step up for large Italian deals – panel

Interest from international players is growing across a variety of sectors, but political uncertainty looms

Literacy acquires fragrance products maker Ashleigh & Burwood

Deal marks the fourth platform investment completed since the fund listing in the LSE last year

IK Partners readies Nomios for upcoming sale process

Bank of America will advise on the auction for the Dutch IT services group, formerly known as Infradata

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

Pinova sells Sill Optics to DPE

Sale of German precision optics manufacturer agreed in bilateral deal

Cornerstone VC holds GBP 20m first close for debut fund

Investments will target UK tech-enabled businesses at pre-seed and seed stage led by diverse teams

Castik Capital gears up for third fund

European mid-market GP held a final close for its predecessor vehicle on EUR 1.25bn in 2019

ICG closes European Corporate fund on EUR 8.1bn

Fundraising exceeds EUR 7bn target set for eight vintage of flagship debt fund

McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist also set to start fundraising for EUR 250m food tech vehicle next month

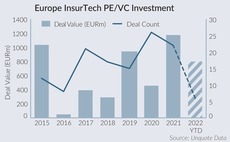

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

Cinven to sell Tractel to trade for EUR 500m

Exit to Sweden-listed Alimak values safety products specialist at 10.3x EBITDA

LDC reaps 4x returns in Aqualisa GBP 130m trade exit

US-headquartered Fortune Brands plans to accelerate growth of shower products manufacturer

Gilde Equity exits Avinty to Main Capital

Dutch e-health solutions supplier is software specialist's first move into healthcare

Permira to exit Vacanceselect to PAI-backed European Camping Group

French campsite operator will have approximately 10% market share in Europe after the acquisition

Aurelius to buy Footasylum following antitrust ruling

Deal values high street sneaker retailer at EUR 45m as owner JD Sports forced to divest

Montagu to exit Arkopharma for EUR 450m

Sale of French supplement maker leaves two unrealised assets in 2010-vintage Montagu IV

SwanCap plans October first close for Fund VI

German GP has a EUR 350m target for co-investment vehicle, which will follow the strategy of 2019-vintage predecessor

Aksia creates Italian Food Excellence Group with three new deals

Acquisitions include Buona Compagnia Gourmet, exited by Gradiente, and Siparex

IK Partners in exclusivity to sell Exxelia to US trade

Aerospace electronic components group to be acquired by HEICO Corporation for EUR 453m in cash

Aliter Capital readies Ipsum for post-summer auction

DC Advisory to lead on sale of UK-based utilities and infrastructure services provider

Tikehau holds EUR 3.3bn final close for TDL V, plans further fundraises

GP said in its H1 2022 results that it has fundraises for its flagship funds in sight for Q3