Sidekick spinoffs: Insurtech scale-ups attract PE interest

Insurtechs have long been overlooked by investors as fintechsт smaller and less-attractive sidekicks. But now, as private equity firms search for rising stars, it seems some scaleups are finally getting to star in their own spinoff series.

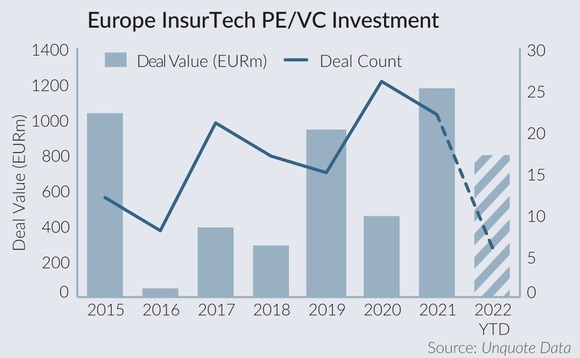

There have been six deals involving PEs investing in or buying out insurtechs in Europe this year with a total disclosed deal value of EUR 800m, according to Unquote data. While the deal count is well below the 22 registered last year, transaction value is on track to comfortably surpass 2021's EUR 1.1bn total.

A broader definition of insurance innovation would yield an even higher count. For example, the data does not include perhaps the biggest transaction of 2022 so far – EQT and Oakley Capital's June agreement to sell Italian car insurance broker and price comparison website Facile.it to Silver Lake for a fee in the range of EUR 1.1bn.

Other notable deals include CVC Capital's March agreement to acquire Italian insurance software provider RGI from Corsair Capital. The target was reported to be worth around EUR 500m.

Digital first

With complex regulation and a small collection of behemoths dominating the market, insurance is not the easiest industry to break into. But as businesses and consumers turned to digital-first financial solutions during the pandemic, insurtech startups jumped at the chance to develop practical technology quicker than their larger, slower-moving peers.

And as insurtechs' user-bases swell, financial investors have been deploying capital. Venture capital and private equity-led funding rounds – often a precursor to full buyouts – have been in full swing this year.

Earlier this month, Berlin-based Wefox raised USD 400m in fresh funding from investors including UAE-based sovereign wealth fund Mubadala Investment at a USD 4.5bn valuation. In June, Toscafund led Instanda's USD 45m round.

France's Garantme, meanwhile, was aiming to attract VC funds for its planned EUR 20m Series B round in March.

Bolt-on deals

With the IPO window seemingly shut for the time being, Europe's larger insurtechs will surely continue to be acquisition targets for financial sponsors hungry for returns. France's Luko and Leocare, as well as Poland's Unilink, are just some of the European insurtechs primed for an exit soon, according to Dealogic's Likely To Issue (LTI) algorithm.

With valuations for tech companies on the slide, PE firms are also choosing to grow their existing insurtech investments through bolt-on acquisitions at discounted rates. There have been 24 M&A deals involving insurtechs in Europe so far this year with a total disclosed value of EUR 2.7bn, according to Dealogic, compared to 31 deals with a total disclosed value of EUR 1.6bn last year.

EQT-backed Luko, for example, has already completed two deals in 2022. And Getsafe, whose sponsor list includes Abacon Capital, expects to make acquisitions on the back of its USD 63m Series B extension.

One thing is for sure: buyout groups will do everything in their power to ensure their up-and-coming insurtech stars come good on their potential.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds