Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Crédit Mutuel Equity boosts German deal hunt with new appointments

Crédit Mutuel Group-backed evergreen fund to plough “several hundred million euros” in DACH

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

Keyhaven bolsters team with six promotions

Secondaries specialist's promotion include Sarah Brereton's advancement to partner

Unquote British Private Equity Awards 2022: deadline extended

Submissions for the 2022 Unquote British Private Equity Awards are now open until 29 July at 5pm

Five Arrows-backed A2MAC1 eyes September auction launch

Car benchmarking group could be valued at EUR 1bn in sale likely to attract major tech funds

Five Arrows exits pharmacy group Laf Sante to Latour

Vendor plans to reinvest in pharmacy chain; Bpifrance takes minority stake

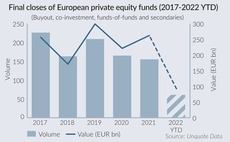

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Bain Capital appoints advisers for Bugaboo exit

Dutch pram maker to hit the M&A pipeline in an auction guided by Baird and Barclays Capital

Eurazeo to reap 3.2x money multiple in Vitaprotech SBO to Apax

French GPs in exclusive negotiations for security specialist deal, which could generate IRR of 30%

Motive raises USD 2.54bn across Fund 2 and co-investment vehicles

GP's USD 1.8bn Fund 2 is 3.7x the size of its predecessor and expects to make 15-18 deals

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller

Mubadala leads equity raise in Wefox's USD 400m Series D

Berlin-based insurtech platform valued at USD 4.5bn in equity and debt round

August Equity to target GBP 400m in fundraise for upcoming sixth fund

Fundraising plans come following several exits from the GPтs 2016-vintage fourth fund

Partners Group hires ZF's Scheider as head of private equity

Car parts maker CEO will join the Swiss GP’s headquarters in Baar-Zug in early 2023

Scale Capital eyes EUR 70m-100m for new VC fund by year-end

Danish GP in talks with institutional investors after EUR 27m first close for Fund III in April

Hg to launch sale of business messaging group Commify

Moelis-led auction is expected to see the UK-based company marketed off EUR 25m EBITDA

Siparex holds EUR 450m final close for ETI 5

Mid cap-focused fund is 60% larger than its 2017-vintage predecessor and has made four investments

Mobeus reaps 4.4x money, 64% IRR on Access Partnership MBO to Mayfair

UK-based technology public policy consultancy seeks to develop via M&A

Equistone weighs auction for United Initiators

Evercore is advising on upcoming sale of the Germany-based specialty chemicals supplier

Erhvervsinvest gears up for Fund V final close in 9-12 months

Danish GP held DKK 1bn first close for small-to-mid cap vehicle; targets hard cap of DKK 2bn

Novum places MMC Studios in continuation fund

New vehicle will allow German GP to complete wind-down of Fund I; DWS Private Equity added as anchor investor

Eurazeo reaps 3.7x money on Orolia exit to trade

Sale of majority stake in French precision electronics group generates EUR 189m in cash proceeds

CapMan exits Fortaco, buys Netox

Sale marks final exit from sponsor's eighth buyout fund; Netox deal is sixth investment via eleventh

Unquote British Private Equity Awards 2022: one more week to enter

Submit your entry for the 2022 Unquote British Private Equity Awards before 15 July 2022 at 5pm