Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Perwyn hires CFO from Silverfleet Capital

James Gavey joins the sponsor's London office after 21 years at Silverfleet

Superangel targets up to EUR 50m hard cap for second fund

Estonian VC firm seeks further institutional investors; SmartCap to make EUR 15m anchor commitment

Apax heads for second small-cap fund with EUR 350m target

French GP seeks private and institutional investors with a minimum commitment of around EUR 100,000

Mayfair exits Talon in SBO to Equistone

UK-based out-of-home advertising agency is looking to expand globally and invest into technology

Carlyle closes in on acquisition of water fountain group Ocmis

US sponsor to beat Ambienta-NB Renaissance consortium with EUR 270m offer for Italian asset

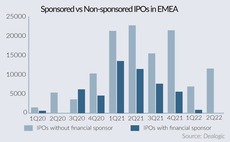

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Curiosity VC eyes EUR 75m fund close in 2023

Dutch investor has commitments from 55 LPs for fund launched last year

Investec builds on private equity, growth equity focus with new appointment

Younger companies in focus with appointment of Kate Gribbon as sponsor coverage head

Levine Leichtman Capital inches closer to first German deal

Planned transaction follows US investor's opening of Frankfurt office in January

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

Inflexion acquires Irish CMO SteriPack

GP will deploy equity from Buyout Fund VI, which closed in March at GBP 2.5bn

Hg appoints advisers for IRIS Software auction

Business software provider could reach EUR 2bn valuation; unclear whether ICG will sell minority stake

August reaps 8x money on Amtivo exit to Charterhouse

GP will reinvest in accredited certification group as minority shareholder alongside management

Adagia in exclusivity to buy Motion Equity's Minlay

GP beats out Apax, Naxicap in auction final round; deal marks second transaction from its debut fund

Algebris holds EUR 200m first close for debut Green Transition Fund

Fund has a EUR 400m target and is headed by three former executives from Italian utility company A2A

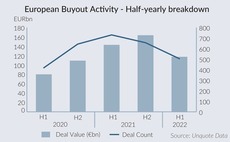

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Apax Partners launches sale of network performance group Infovista

Jefferies and SocGen advise on auction; indicative bids due before summer break

AlpInvest leads Equistone's Sicame continuation fund deal

The deal is Equistone's inaugural continuation vehicle in process first reported by Unquote

William Blair poaches peers in European advisory boost

Five senior hires announced across technology, services, industrials, and debt advisory teams

Waterland invests in tax and audit advisor Cooper Parry

GP is deploying capital from Fund VII, where many other business support services companies sit

Howden hires KPMG's O'Connor, launches capital advisory business

New group aims to address its clientsт need for complex insurance and investment solutions

Apax Partners hires head of Italy to bolster local presence

Marco Conte joins from Trilantic to support the French GP’s work in its pipeline of Italian SMEs

Levine Leichtman Capital appoints head of Europe

Promotion of Josh Kaufman comes as GP looks to grow its nascent German investment capabilities

Capza launches SME decarbonisation fund with EUR 1.3bn target

Second vintage of the SME-focused strategy will aim to support its portfolio companies with decarbonisation