Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

17Capital closes debut Credit Fund on EUR 2.6bn

Fund is the GP's first to focus on NAV financing in the form of credit, rather than preferred equity

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

Alantra bolsters private debt team with new appointments

Hires include managing directors Alberto Pierotti and Jean-Philippe Lantrade

Bowmark buys workflow automation provider WSD

GP will seek to expand London-based companyтs product development and grow in North America, Europe and Asia

Main sells Obi4wan to PE-backed Spotler

Exit to CNBB portfolio company Spotler Group ends a holding period of almost six years

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Investindustrial sells Neolith to CVC VIII

During Investindustrial tenure Neolith posted EUR 145m in revenues in 2021 and an EBITDA CAGR of approximately 20%

Buyout groups circle Trivium Packaging auction

Owners OTPP and Ardagh requested non-binding offers last week after distributing sale materials in March

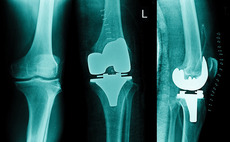

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

Tilt Capital holds first close for debut energy transition fund

Co-founder Nicolas Piau speaks to Unquote about the GP's Siparex partnership. fundraise and strategy

Qualium III expects autumn final close

Vehicle will follow the investment strategy of its predecessor and has a EUR 500m target

IK Partners sells Recocash to Qualium Investissement

Deal marks the third exit from IK Small Cap II, which is at least 93% deployed

LGT's Batisanté draws interest from multiple sponsors in hotly contested sale

GPs including Chequers, Equistone, IK, Latour and Naxicap are circling the LGT-backed firm

ICG, Ares and GBL among sponsors in Sanoptis second round

Current backer Telemos wants to remain invested as a minority shareholder in the ophthalmology group

EMZ exits Ankerkraut to Nestlé for 2x money

Deal marks the first full exit for EMZ Fund 9 and ends a holding period of less than two years

Convent Capital holds first close for Agri Food Growth Fund

Growth capital vehicle will invest EUR 5m-EUR 20m per deal and has made its first investment

Hg bolsters team with promotions and new hires

GP has promoted three to partner and fills newly created role, head of talen

Getir backer Re-Pie launches EUR 70m VC fund

Re-Pie Ventures 1 plans to hold a first close by the end of 2022, general partner Mehmet Ali Ergin said

Capital Croissance gears up for Smart AdServer exit

GP bought a majority stake in the France-based digital advertising platform from Cathay in 2021

Parcom prepares insurance provider TAF for exit

Parcom acquired a majority stake in the Netherlands-based business in December 2018

Melior Equity Partners holds EUR 160m final close for debut fund

Irish SME-focused GP is led by former Carlyle managing directors Jonathan Cosgrave and Peter Garvey

Briar Chemicals owner Aurelius launches sale process

Aurelius had previously gauged interest for the chemicals producer in 2019, Mergermarket reported

Carlyle acquires life sciences investor Abingworth

Deal follows EQT's acquisition of LSP in November 2021 as asset managers look for greater specialisation

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year