Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Inovexus gears up for seed investments in AI, blockchain, metaverse startups

Evergreen fund's LPs include Crédit Agricole, according to Inovexus CEO and founder Philippe Roche

Advent buys IRCA in SBO from Carlyle

Bakery ingredients firm has a reported EV of EUR 1bn and is expected to post 2022 EBITDA of EUR 75m

Silverfleet exits Prefere Resins in SBO to One Rock

Concerns about Russian exposure and raw materials costs surfaced in the sale process, Mergermarket reported

Volpi hires Fairlie from Synova

Tech specialist closed its second fund in January 2021 and has made three hires this year

EMZ acquires FotoFinder Systems

EMZ is acquiring a majority stake in the medical imaging company via EMZ 9, which is 80% deployed

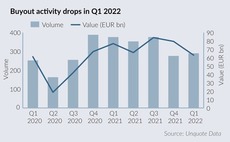

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

SEB Private Equity sells Norcospectra to Accent

Commercial interiors business is expected to expand via add-ons and develop its digital offering

Ganni sponsor L Catterton appoints Lazard to explore sale

Denmark-headquartered online fashion retailer could come to market in H2 2022, Mergermarket reported

Bridgepoint in exclusivity to acquire G Square's Dentego

Mergermarket reported that sponsors including Ardian, BC, Eurazeo and IK showed interest in the asset

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

Novo-backed ReViral acquired by Pfizer

The British biotech company is also backed by CR-CP, New Leaf, Andera Partners, and OrbiMed, among others

Phoenix exits Forest Holidays for 3x money

Buyer is Sykes Holiday Cottages, a portfolio company of Vitruvian Partners and Livingbridge

Altor in early dual-track preparations to exit Transcom

Rothschild is mandated as sale adviser for the Swedish BPO group, while JP Morgan will advise on IPO track

Scout24 eyed by buyout groups including H&F, EQT, Permira

The downward trend in its share price has put the German real estate marketplace back on the radar of cash-rich sponsors

H2 Equity exits premium logistics group Cadogan Tate to TSG

US sponsor plans to use acquisitions to expand the London-headquartered company abroad; management will retain minority stake

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Gimv forms digital marketing agency Olyn

Company is built through four assets; will pursue further acquisitions locally and abroad

Inflexion sells Marley for 3.5x, 58% IRR

Sale to listed construction firm Marshalls values the roofing tile specialist at GBP 535m

Accent exits Motum to Mitsubishi Electric

Sale of Swedish elevator services group marks the 12th exit from the Accent Equity 2012 fund

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

Dental Directory sees Exponent, Equistone bare teeth in sale second round

DC Advisory is expected to review final bids for the carve-out from Palamon-backed IDH Group in about a month

JamJar closes second fund on GBP 100m

JamJar Fund II is the consumer technology-focused first fund with institutional investor backing

Nordic forms Bilthouse through mortgage broker acquisitions

The GP will merge Baufi24, Hüttig & Rompf and Creditweb to form new company; deal made through Nordic Capital X

Advent buys Mangopay, Leetchi

Deal adds to GP's 17 fintech assets including Planet and Medius; sponsor has invested USD 6.5bn in fintech since 2008