Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Labour unveils plan to target carried interest taxation

Carry to remain taxed as capital gains, BVCA understands

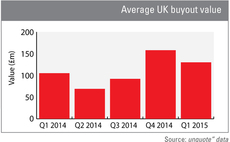

Average UK buyout value up 24% year-on-year

Q1 2015 average value down on Q4 2014 spike, however

Ardian secures minority stake in Serma

SBO sees management co-invest to secure 57% stake

DN-backed windeln.de reveals plans for €200m IPO

Offering comprises €100m new and €80m existing shares

NorthEdge's Rawlinson promoted to CFO

NorthEdge promotes Emma Rawlinson from finance director to chief financial officer

ICG to take over Courtepaille in debt-for-equity swap

ICG supplied €160m unitranche in 2010 Fondations Capital buyout

HIG Europe acquires Fågelviksgruppen

EV understood to amount to SEK 2-3bn

LBO France in exclusive talks to acquire IKKS

Investment will be sourced via LBO's White Knight IX fund

Asgard Capital launches in Berlin

First fund, focused on digital hardware investments, being raised

Oakley Capital acquires Holtzbrinck's Parship

German online dating site and mobile app sold to UK investor

Foresight-backed The Bunker completes recapitalisation

Recap generates 1.8x return for Foresight VCTs

Ardian's CLS acquires Horizon Marine

Massachusetts-based company is second US subsidiary for CLS

KCP's Templine picks up Corinium Employment

Deal marks Templine's fourth bolt-on since 2007 MBO

Isai reaches €55m first close for latest venture fund

Total exceeds €35m target after a few weeks of fundraising

MBO Partenaires backs Noukie's

Firm invested via its MBO Capital 3 fund

Cipio reaps 3x on Ipanema trade sale

Company was the last of the T-Venture portfolio acquired in 2004

Deal in Focus: Triton sells down final Stabilus stake

Final selldown marks the end of a successful turnaround

Lloyds bolsters northern acquisition finance team

Rob McCann is promoted to director, while Will Johnson joins as associate director

InVivo NSA raises €215m from Eurazeo et al.

Eurazeo contributes €114m to round, secures 17% stake

Verdane and Nexit sell Octoshape to Akamai

Exit is Verdane's second from Nordic Venture Partners portfolio

Debevoise names two new partners

Sally Gibson and Richard Lawton have been promoted to partners

Rothschild backs ACE Group

Company plans to double number of existing offices

Beringea leads £13m round for D3O

Exisiting investor Entrepreneurs Fund commits ТЃ3m to round

Foresight injects £1m into Morgan Tucker

Capital will be used to bolt-on another consulting firm