Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Ace Capital raises EUR 175m for cybersecurity fund

Brienne III held a first close on EUR 80m in June 2019 and ultimately exceeded its target

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

Burger King UK owners mull GBP 600m listing – report

IPO plans are thought likely to be formalised within days, dual-track process could be explored too

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

DPE's Calvias hits DACH auction pipeline

DPE has built Calvias through a string of acquisitions since its 2015 buyout

RGI sale by Corsair Capital draws CVC, Nextalia interest

Carlyle, Investindustrial and TA Associates are also among the sponsors showing initial interest

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

VC-backed Truecaller lists on Nasdaq Stockholm

Caller identification software is backed by VCs including Sequoia Capital and Atomico

H&F matches EQT's EUR 3.36bn Zooplus offer

H&F has increased its EUR 460 per share offer for the pet products retailer to EUR 470 per share

Summa sells Lakers for 5x money

GP acquired the waste and wastewater pump service provider in 2018 via its debut fund

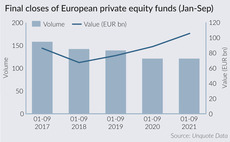

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

Finberg to raise USD 25m for new IFR fund

Turkish corporate VC firm backed by Fibabanka and Fiba Group moves toward third-party funding

Accent Equity Partners to launch Inteno Group sale

Auction is expected to kick off in the early part of Q4 2021, sources say

ECI sells CPOMS to PE-backed Raptor

ECI bought the educational safeguarding software in 2018, investing via its GBP 500m ECI 10 fund

LDC sells Mandata to Tenzing

LDC acquired the transport and logistics software developer in a GBP 20m SBO from Synova in 2018

HealthCap makes raft of senior appointments

Nordic-headquartered life sciences and healthcare VC is deploying equity via HealthCap VIII

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Comdata sponsor Carlyle Group taps Citi to prepare auction

Carlyle acquired Comdata from Altair in December 2015, in a deal valuing Comdata at 4x EBITDA

CFC Underwriting attracts Blackstone Group and OTPP

A deal could value CFC at an EBITDA multiple in the high teens or north of 20x

Main Capital raises EUR 1.2bn across two funds

Of the capital raised, Main Foundation I has raised EUR 210m to back smaller software companies

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

PAI lines up next flagship fund

PAI Partners VIII is registered in Luxembourg, with its predecessor having raised EUR 5bn in 2018

British Private Equity Awards 2021: winners announced

Congratulations to the winners of this year's British Private Equity Awards, announced last night in London

ArchiMed invests in Xpress Biologics

Plasmid DNA and protein therapy developer is an investment from the GP's Med II fund