European buyout dealflow up 36% year-on-year in Q3

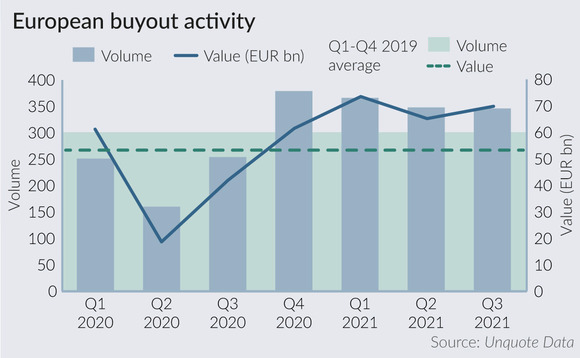

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, marking a significant rebound on the comparable period last year, according to preliminary figures from Unquote Data.

The volume total for Q3 2021 is virtually identical to the 348 deals recorded in the second quarter and is in fact likely to exceed it in due course, as Unquote researchers inevitably uncover more transactions in the coming weeks. In aggregate value terms, the EUR 69.8bn announced over the summer marks a slight uptick on Q2's total, but is still shy of the all-time record of EUR 73.5bn seen in Q1 this year. Deal volume was also higher by a small margin in both Q4 2020 and Q1 2021.

Nevertheless, the preliminary Q3 tally confirms the robust health of the deal-doing environment in 2021 so far. While the Q3 2020 figures were still affected by the first wave of the Covid-19 pandemic, similar periods in 2019 and 2018 also saw less plentiful dealflow (338 and 292 buyouts, respectively) while aggregate EV figures were also considerably lower.

Reflecting a similarly strong exit activity for sponsors, Q3 dealflow was more heavily slanted towards secondary buyouts than usual. Around a third (32.5%) of European buyouts were sourced from fellow GPs between July and September, compared with 29% in Q2 and 25% over the preceding 12-month period.

France was once again the busiest buyout market in Europe over Q3 with 77 transactions, up 16% on Q2 figures and accounting for 22.3% of all buyout dealflow. The UK remained about as busy as in Q2 and was home to 18.8% of European activity, followed by Germany with 14.7%.

Should activity continue at a similar pace in the fourth quarter, Europe could see around 1,400 buyouts announced by year-end, for an aggregate EV approaching EUR 280bn. This would mark a spectacular 33% recovery on 2020 year-end figures, and would also set a new all-time record for European buyout activity.

Largest European buyouts announced in Q3 2021

| Deal | Date | Sector | Country | Value (EUR m) |

| T-Mobile Netherlands | Sep 2021 | Mobile telecommunications | Netherlands | 5,100 |

| Ceramtec | Aug 2021 | Diversified industrials | Germany | 3,800 est |

| Zegna | Jul 2021 | Clothing & accessories | Italy | 2,694 |

| Polynt and Reichhold | Jul 2021 | Speciality chemicals | UK | 2,600 |

| Allego | Jul 2021 | Electrical components & equipment | Netherlands | 2,077 |

| ITP Aero | Sep 2021 | Aerospace | Spain | 1,800 |

| Pharmathen | Jul 2021 | Pharmaceuticals | Greece | 1,600 est |

| Seqens | Aug 2021 | Speciality chemicals | France | n/d (1,500-2,000) |

| Almaviva Sante | Jul 2021 | Healthcare providers | France | 1,500 |

| Restaurant Brands Iberia | Jul 2021 | Restaurants & bars | Spain | n/d (>500) |

source: Unquote Data

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds