European GPs raise record amounts in first nine months of 2021

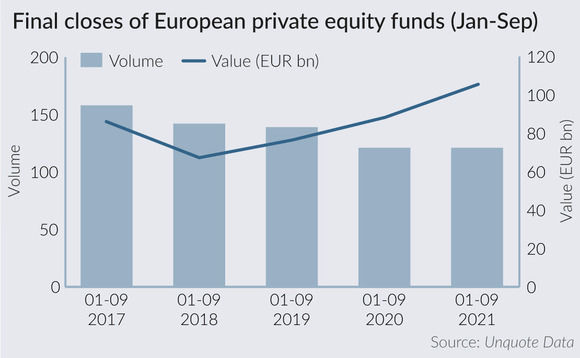

European private equity managers closed funds totalling EUR 105.5bn in commitments between January and September, a 30% increase on the average amount raised in comparable periods over the previous four years.

In the first nine months of 2020, European GPs raised a total of EUR 88.3bn at final close (excluding credit vehicles), according to Unquote Data. Despite the impact of the coronavirus outbreak in Q2 2020, this was already the highest first-nine-months amount ever recorded by Unquote. Between January and September 2019, that figure stood at EUR 76.5bn.

That said, this year's aggregate commitment total illustrates the continued bifurcation at play in the market. This record amount was raised across 121 funds, the exact same number of vehicles closed in the first nine months of 2020. As a result, the average size of funds closed in 2021 stands at EUR 872m, against EUR 729m in the comparable period in 2020. By comparison, this average size stood at EUR 474m in the first nine months of 2018.

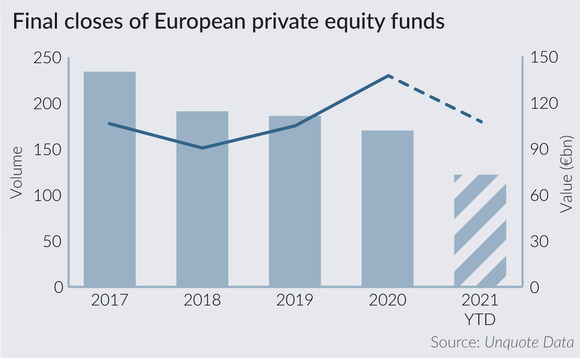

This strong haul of capital so far in 2021 points towards a new year-end record being set, although the natural ebb and flow of fundraising cycles and the impact of mega-fundraises make this harder to predict than for investment activity. Should fundraising continue at the same pace in Q4, European managers could end up raising in excess of EUR 140bn, breaking the previous record set last year with a EUR 137bn total.

This could depend on the timing of a handful of high-profile raises currently underway. BC Partners (which owns a minority stake in Unquote publisher Acuris) should be nearing the end of its effort, having held a first close on EUR 4bn towards its EUR 8.5bn target a year ago. Bridgepoint is also officially back in the market for its latest flagship private equity fund, Bridgepoint Europe VII, with a target of EUR 7bn, as reported.

Other processes include Permira's new buyout fund, with the GP having filed documents with Luxembourg's Registre de Commerce et des Sociétés on 26 July, most likely on the hunt for a double-digit billion target. Meanwhile, French GP Astorg is also preparing for its eighth flagship, having registered the fund in late June – its current vehicle raised EUR 4bn in 2019. PAI has also just registered its next flagship, while other large GPs thought to be in the market include Cinven, Charterhouse, Advent International, and more.

Whether or not these efforts can cross the line in Q4, or contribute towards similarly strong figures in 2022, remains to be seen. In any case, it is very likely that the vast amounts of capital secured in 2021 will have been attracted by a dwindling pool of managers: the overall number of funds closed this year is unlikely to significantly exceed 160 vehicles, which would mark a five-year low.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds