Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Equistone sells Bruneau to Towerbrook

Earlier media report put the EV of the French online office supplies retailer at EUR 475m

Mandarin Capital mandates advisers for Italcer sale

Sale will kick off later in the year, targeting both private equity firms and industry players

Eurazeo NAV per share hits record high

AUM grew by +39% over the 12 months to June 2021, to reach €25.6bn

Bregal acquires Advent-backed Laird Thermal Systems

Advent acquired LTS's parent company Laird in a GBP 1.2bn take-private in 2018

ICG takes EUR 1.45bn ESG-linked facility for Europe VIII

Standard Chartered Bank was coordinator and mandated lead arranger on the facility

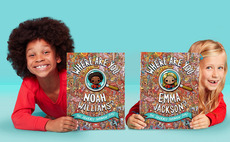

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Permira registers eighth flagship fund

GP could be aiming for more than USD 15bn, up from EUR 11bn for Permira VII, according to an earlier report

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

Eurazeo closes Idinvest Private Debt V on EUR 1.5bn

Fund exceeds its EUR 1.2bn target and is already deployed at nearly 80%, with a successor lined up

Tikehau holds EUR 617m final close for European Special Opportunities II

Fund surpassed its EUR 500m target and is more than 50% deployed, with a 68% re-up rate

Trilantic invests in Smile Eyes

Trilantic intends to pursue a buy-and-build strategy for the German ophthalmology clinic chain

Alpha Private Equity sells Vertbaudet to Equistone

SBO of the children's clothing and accessories retailer is Equistone's sixth platform deal of 2021

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Bayer ESP eyed by Bain, Cinven ahead of post-summer sale launch

Bayer could expect to fetch in excess of EUR 2bn for ESP, two sources say

IGI to assess strategic options for Nuovaplast

Manufacturer of PET preforms Nuovaplast attracted unsolicited approaches by European industry players

Apax advised by UBS on Wehkamp exit

Dutch online warehouse Wehkamp is expected to come to market in H2 2021

Palamon exits Feelunique in GBP 132m sale to Sephora

Palamon acquired the UK-headquartered online beauty products retailer for GBP 26m in 2012

Eurazeo Growth III holds final close on EUR 1.6bn

Vehicle surpassed its EUR 1bn target and will provide initial equity tickets of EUR 25m-100m

Baird Capital holds final close for second Global Fund

Vehicle will continue to back founder-led UK, US and Asian SMEs via buyout and growth deals

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

EQT explores strategic options for Banking Circle

Options include a private sale and a merger with a blank-cheque company, as well as a listing via IPO

KKR readies German auto parts maker Tekfor for September sale

KKR attempted to exit Tekfor around two years ago in a sale process that was ultimately inconclusive

Ardian buys stake in Nova Reperta

Investment in the management consultancy is Ardian Growth's first investment in Belgium

Unigestion launches second emerging-manager fund

Vehicle has a target of EUR 300m and will back first- and second-generation buyout and growth funds