Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

France's Elior and Nord-Est in refinancings

Charterhouse's catering business Elior has tapped into the high-yield market to raise €350m, while Oaktree has been able to reap a dividend by leveraging its investment in packaging company Nord-Est, according to local reports.

Charterhouse buys Armacell for €500m

Charterhouse has agreed to acquire German insulation company Armacell from Investcorp in a €500m secondary buyout.

Herkules's Bandak Group acquires ITM

Herkules Capital portfolio company Bandak Group AS has agreed to acquire IOS Tubular Management AS (ITM) from Breimyra Invest AS.

Novartis Venture et al. in €33m series-C round for Opsona

A consortium of new and existing investors has injected тЌ33m into Irish immunology drug development company Opsona Therapeutics as part of a series-C funding round.

New Look launches £800m bond offering

Apax- and Permira-backed New Look Group has launched an ТЃ800m senior secured notes offering to pay down its debt.

Candover's Alma Consulting in refinancing talks

Alma Consulting, a French corporate cost-reduction advisory business owned by Candover, could be taken over by its mezzanine lenders, according to local reports.

DFJ Esprit et al. back M-Files Corporation

DFJ Esprit and Finnish Industry Investment have injected тЌ6m into M-Files Corporation, a technology start-up based in Finland.

FF&P Private Equity acquires FIT

FF&P Private Equity has backed the buy-in management buyout (BIMBO) of specialist energy efficiency firm Food Industry Technical Ltd (FIT).

Springer Science sale back on

Germany could be home to another mega-buyout this year following news that EQT is in renewed talks with private equity investors over a potential sale of German publishing business Springer Science.

VC-backed Shazam to pursue IPO

Shazam, a London-based mobile music recognition app developer, is to pursue an initial public offering.

Herkules Capital exits Gothia to arvato AG

Herkules Capital has agreed to sell Gothia Financial Group AS to arvato AG, a global business process outsourcing (BPO) provider owned by Bertelsmann.

PAI scoops up R&R Ice Creams

French large-cap specialist PAI partners has struck a deal to buy British ice cream manufacturer R&R Ice Cream from Oaktree Capital for тЌ850m.

Partech appoints Romain Lavault as general partner

French technology-focused venture capital firm Partech International has appointed Romain Lavault as general partner.

Bridges Ventures launches £14m social impact fund

Bridges Ventures and Big Society Capital have launched the Bridges Social Impact Bond Fund with ТЃ14m in commitments.

LDC appoints Whitwell as investment director

LDC has appointed Richard Whitwell as investment director in its Birmingham office.

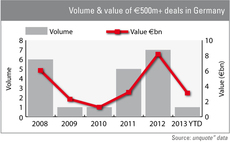

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

Bridgepoint leads Cote auction

Bridgepoint has emerged as the front-runner in the bidding process for UK-based restaurant chain Cote, which is expected to sell for ТЃ100m, according to reports.

Zukunftsfonds Heilbronn, HTGF et al. back Compositence

Zukunftsfonds Heilbronn has become the lead investor in German carbon-fibre components company Compositence following a capital increase round that also included fresh investment from High-Tech Gründerfonds (HTGF) and Mittelständische Beteiligungsgesellschaft...

Better Capital acquires City Link for £1

Turnaround player Better Capital has bought UK courier company City Link Ltd from Rentokil Initial plc through its Becap12 fund for a symbolic ТЃ1.

France to cut back on capital gains tax

Following months of complaints by local entrepreneurs, French president François Hollande is due to announce a simplified and more favourable capital gains taxation regime.

German activity sluggish despite mega-deals

German activity

KKR provides debt financing to Spain's Uralita

KKR Asset Management, KKR‘s sub-investment grade manager, has provided a €320m seven-year facility to Spanish building materials firm Uralita.

Easton Corporate Finance appoints new MD

French M&A advisory firm Easton Corporate Finance has promoted co-founder Thomas Gaucher to managing director.

Mobeus in ATG Media bolt-on

Mobeus Equity Partners has made an add-on investment of ТЃ4.5m in portfolio company ATG Media to finance the acquisition of US-based online auctions site BidSpotter Inc.