Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Delta Lloyd drops out of private equity

Delta Lloyd has disposed of the private equity management arm of its investment division, Cyrte Investments BV, and will reportedly no longer deal in the private equity sector in the wake of the Solvency II directive.

Steadfast Capital hires three

Steadfast Capital has expanded its investment team by recruiting Friedrich Ysenburg, Tim Ottenbreit and Sandra Stohler.

Newion acquires stake in Reasult

Newion Investments has acquired a minority stake in real estate software provider Reasult via its third fund, Newion II.

PE-backed Kion Group to list

German forklift manufacturer Kion Group, backed by KKR and Goldman Sachs Capital Partners, is considering an initial public offering, according to reports.

Permira sells more Hugo Boss shares

Permira is to sell seven million shares, or a 10% stake, in German high-end fashion house Hugo Boss, according to reports.

Elysian Capital buys Axis Well Technology

Elysian Capital has backed the management buyout of Aberdeen-based oil and gas consultancy Axis Well Technology.

Electra to reap 15x on Allflex

BC Partners has made a binding offer of $1.3bn to Electra Partners for its French animal tags business Allflex, following an intense auction process that attracted bids from a dozen private equity firms.

Norwegian state injects NOK 500m into VC fund

The Norwegian government is set to commit NOK 500m to Investinor AS, a venture capital investment company owned by the Norwegian Ministry of Trade and Industry.

Intel Capital leads €7m funding round for FeedHenry

Intel Capital has led a group of GPs and one trade player in a тЌ7m funding round for cloud-based mobile applications platform provider FeedHenry.

DACH unquote" May 2013

CVC’s €3bn buy-back of Ista in April caused much excitement for German private equity in 2013, though a deeper look at the figures reveals that the asset class had got off to a bad start this year.

Nordic unquote" May 2013

For almost 40 years, Sweden was one of the few countries in the world where private retail of pharmaceuticals was banned.

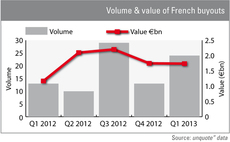

French buyouts up 50% YoY in Q1

The French buyout market enjoyed a much welcome uptick at the start of 2013, with both volume and overall value significantly up on Q1 2012 figures.

France unquote" May 2013

“Some key ideas are currently gaining ground,” said Afic chairman Louis Godron at the association’s annual conference in Paris last month, “notably when it comes to the crucial role of competitiveness in the country’s future and the importance of entrepreneurs....

UK & Ireland unquote" May 2013

The UK & Irelandтs first quarter activity levels are at their lowest level for the past five years, according to the latest research from unquoteт data.

Novo AS et al. round up €141m Symphogen financing

Novo AS, PKA and Danica Pension have provided Danish biopharmaceutical company Symphogen with a further тЌ41m, rounding up a тЌ141m funding round for the business.

Calculus Capital and SAEV invest in Antech

Calculus Capital and Saudi Aramco Energy Ventures (SAEV) have backed UK-based Antech, a developer of directional coiled tubing drilling products and services.

Duke Street hunts for new backers ahead of fresh fundraising

Duke Street Capital is looking for new backers to replace existing investors in its funds ahead of a fresh fundraising attempt, according to reports.

Swedish GPs cash in on pharmaceutical reform

Swedish healthcare bonanza

Argos seals Sage subsidiaries deal

Mid-cap GP Argos Soditic has completed the all-equity acquisition of four software-focused subsidiaries of Sage in France and Spain.

Invision buys Kraft & Bauer

Swiss firm Invision Private Equity has bought German fire protection business Kraft & Bauer Brandschutzsysteme (K&B) as part of a succession solution.

Capital gains tax overhaul welcomed by Afic

French CGT

Panoramic invests £1.8m in Andante Travels

Panoramic Growth Equity has injected ТЃ1.8m into archaeological travel operator Andante Travels via its maiden fund, Panoramic Enterprise Capital Fund I (PECF I).

Isis backs Sage Construction MBO

Isis Equity Partners has backed the MBO of Sage Construction from software company Sage (UK) Ltd.

Almi and Chalmers Innovation back Halon

Almi Invest and Chalmers Innovation Seed Fund have backed Swedish web security solutions provider Halon Security.