Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Odewald & Compagnie sells mateco stake to TVH

Odewald & Compagnie (O&C) has sold its stake in German aerial platform provider mateco Gruppe to Belgian trade buyer TVH.

BGF backs Peyton and Byrne with £6.25m

The Business Growth Fund (BGF) has injected ТЃ6.25m into Peyton and Byrne, a London-based restaurant, retail bakery and events business.

North West Fund for Biomedical backs TTS Pharma

The North West Fund for Biomedical has invested ТЃ550,000 in TTS Pharma, a UK-based developer of personalised nicotine patches for smokers.

Dunedin backs £34.5m MBO of Premier Hytemp

Dunedin has supported the MBO of Scottish oil and gas exploration equipment manufacturer Premier Hytemp from Murray International Holdings.

Nordic PE investment fell in Q3

Private equity funds invested around тЌ1.1bn in the Nordics in the third quarter, тЌ750m less than in Q2, according to the Argentum Q3 2012 Report. The figures paint Q3 as the trough for the region this year.

Ratos sells Contex to Procuritas for $41.5m

Ratosтs portfolio company Contex Group has signed an agreement to sell Danish Contex AS to the private equity fund Procuritas Capital Investor V LP for a total of $41.5m.

Vesalius and SRIW lead €10m series A round in Euroscreen

Vesalius Biocapital Partners and SRIW have led a €10m funding round in Belgian pharmaceuticals company Euroscreen.

Montagu and GIP exit Biffa via debt-for-equity swap

Montagu Private Equity and Global Infrastructure Partners (GIP) have exited UK waste services company Biffa via a debt-for-equity swap with the company's senior lenders.

Lonsdale in MBO of funeral service provider Avalon

UK small- to mid-cap house Lonsdale Capital Partners has backed the MBO of Avalon Funeral Plans.

Newfund invests €1.5m in Invoxia

Newfund has invested €1.5m in French telecommunications business Invoxia.

France's fiscal cliff-hanger

Fiscal cliff-hanger

Dunedin reaps 3x money multiple on etc venues exit

Dunedin Capital Partners has exited UK-based conference and training venues business etc venues in an SBO to Growth Capital Partners (GCP), reaping a 3x money multiple on its original investment.

Gimv and Iris Capital sell stake in Human Inference

Gimv and Iris Capital have sold their share of Dutch data management solutions provider Human Inference to French trade buyer Neopost.

Enterprise Ventures invests in Isis Forensics

Enterprise Ventures (EV) has backed UK-based forensics software developer Isis Forensics with funds from its North West Fund for Venture Capital and Lancashire County Councilтs Rosebud Fund.

Connect Ventures invests in Teleportd

Connect Ventures has invested in a $1m seed funding round for French social media marketing management company Teleportd, according to reports.

Alto makes 2x on Monviso SBO

PM & Partners Private Equity has acquired Italian food producer Monviso from Alto Partners.

Nordic Capital refinances Orc with €60m bond issue

Orc Group, a Swedish financial technology and services provider owned by Nordic Capital, has placed a five-year тЌ60m senior secured high-yield bond.

Norrlandsfonden refinances Mackmyra

Norrlandsfonden has extended its convertible debt facility for Swedish whisky distillery Mackmyra Svensk Whisky AB for another five-year period.

Principia backs Itsworld with €2m

Italian VC firm Principia has injected €2m into Itsworld Sicilia in exchange for a 28% stake in the firm.

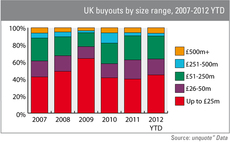

UK mid-market most affected by recession

The mid-market has suffered more during the double dip recession than other market segments, according to figures from unquoteт data.

Iris Capital opens North American and Asian offices

French venture capital firm Iris Capital has opened further offices in the US, Canada, China and Japan.

CT Investment Partners et al. back Cable-Sense

CT Investment Partners' North West Fund for Energy & Environmental and MTI Partners' UMIP Premier Fund have backed UK-based infrastructure management company Cable-Sense with ТЃ800,000.

NTC Holdings further reduces stake in TDC

The holding jointly owned by Apax, Blackstone, KKR, Permira and Providence has sold 80 million shares in Danish telecommunications company TDC.

BC Partners and TPG given go ahead for OPAP tender

BC Partners and TPG are among the seven potential investors that have been cleared to continue to the next phase of a tender to buy a 33% stake in Greek lottery monopoly OPAP.