Southern Europe

BC Partners to join Bain as co-investor in Fedrigoni

Valued at around EUR 3bn, the Italian paper and label manufacturer will also receive co-investment from Canson Capital

StepStone Group gears up for next Tactical Growth Fund

Predecessor primary, secondaries and co-investment vehicle held a final close in 2021 on USD 690m

Trilantic to buy Passione Unghie in SBO from Orienta

Incumbent GP and founders retain minority stake; deal includes unitranche led by Eurazeo and HIG

Miura Partners raises first EUR 150m impact fund

Spanish GP’s new vehicle will have its carried interest linked to portfolio companies’ impact goals as well as financial performance

Ambienta plans asset class expansion following EUR 1.55bn Fund IV close

Environmental investor set for first deals with new fund in 2023 as it assesses a foray into new asset classes and geographies, founder and managing partner Nino Tronchetti Provera tells Unquote

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

Charterhouse expected to launch Optima's sale by early 2023

Owner is yet to appoint advisors to guide it on exit of Italian food ingredients producer

Investindustrial to reap 2.5x money in Natra sale to CapVest

New owner will support Spanish chocolatier's organic growth and potential transformational acquisitions

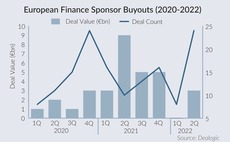

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

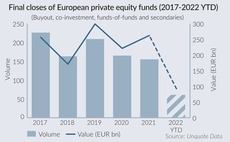

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Motive raises USD 2.54bn across Fund 2 and co-investment vehicles

GP's USD 1.8bn Fund 2 is 3.7x the size of its predecessor and expects to make 15-18 deals

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller

Carlyle closes in on acquisition of water fountain group Ocmis

US sponsor to beat Ambienta-NB Renaissance consortium with EUR 270m offer for Italian asset

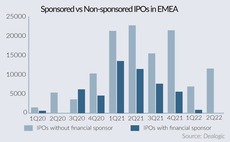

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

Algebris holds EUR 200m first close for debut Green Transition Fund

Fund has a EUR 400m target and is headed by three former executives from Italian utility company A2A

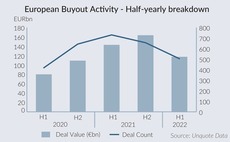

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Apax Partners hires head of Italy to bolster local presence

Marco Conte joins from Trilantic to support the French GP’s work in its pipeline of Italian SMEs

ICG, Merieux Equity to exit DOC Generici to TPG

Secondary buyout sees San-Francisco-based GP pre-empt auction for Italian generic drugmaker

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments

Cobepa buys majority stake in Salice

Belgian sponsor invests alongside Italian furniture hinges manufacturer’s family shareholders

Bain Capital, Nextalia to acquire Deltatre from Bruin Sports Capital

Italian sports technology provider first sale attempt was hampered by the onset of COVID-19 in early 2020

Oakley, EQT seal Facile.it sale to Silver Lake

Sale to Californian tech investor gives Italian price comparison platform unicorn status

Dunas Capital holds first close for debut impact fund

Vehicle plans to enter distribution partnership with private bank for its EUR 50m fundraise