Southern Europe

Mindful Capital hires adviser to sell Italian Frozen Food Holding

Vitale will guide the sponsor in an auction expected to launch between September and October

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

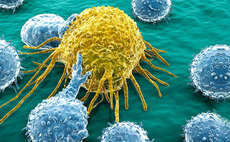

Nexxus Iberia nets 4.2x on Bienzobas exit to trade

Sale of oncology group marks GP's second exit from debut fund; buyer Atrys pays 8.5x EBITDA

Ardian's Dedalus sale postponed until September

Owners of Italian software group in “wait-and-see mode” as M&A faces challenging environment

Alto preps new vehicle as Fund IV deployment nears completion

Italian investor is preparing for new fund investing in Italian SMEs specialising in consumer, industrial, services and pharma sectors.

360 Capital holds EUR 45m first close on early stage tech fund

Square II will invest in pre-seed and seed rounds with a focus on French B2B software, consumer disruption, deeptech

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Unigestion launches third Direct fund with EUR 1bn target

Strategy invests in mid-market companies alongside the GP's investment partner network

GP Profile: Kyip Capital on debut fundraising, opportunities in Italian education

After interim close, Milan-based fund seeks up to EUR 165m by early 2023; eyes deals to grow data validation business and university platform

Alto Capital sells CEI Group to White Bridge

Vendor will reinvest with a minority stake in the automotive spare parts manufacturer via the same fund

LPs' net returns highest since financial crisis – Coller Capital

Secondaries specialistтs Summer 2022 Barometer shows that half of LPs want to increase their allocation to alternatives, with 91% still committing to PE first closes with incentives

Sun European acquires Tenax

The sponsor invested through its latest fund, Sun Capital Partners VIII, acquiring an 80% stake.

Aurica raises EUR 170m for fourth growth fund

Aurica Growth Fund IV will take minority stakes in companies with an EBITDA of around EUR 4m

Alcedo could launch Agrimaster sale in late 2022

Italian GP bought the agricultural machinery producer in 2017 via a EUR 30m SBO from B4 Investimenti

Gemba Private Equity heads for EUR 25m close for debut fund

Spanish GP is looking to attract further LPs interested in the local mid-cap space

Ufenau acquires EinzelNet in first deal with Fund VII

Management and founders will retain a 25% stake in the Spanish IT services group; bolt-ons planned under new owner

B4 Investimenti on track for new fund launch in late 2023

Italian GP plans to hit the road for Fund III after the end of its current vehicle’s investment period

Alcedo heads for June final close for Fund V

Italian GP has received EUR 230m in commitments to date for Fund V against a EUR 250m hard-cap

Ergon et al. sell Indo to PE-backed Rodenstock

Sherpa Capital and Oquendo Capital are also selling their stakes in the ophthalmic lenses producer

Portobello Structured Partnership holds EUR 250m final close

Vehicle is the GP's first dedicated fund for minority stakes in Southern European mid-market companies

Podcast: In conversation with... Mark Corbidge, Sun European Partners

Sun European Partners' Mark Corbidge tells Unquote about the GP's strategy and current market view

General Atlantic hires Inditex's Isla as global senior advisor

Growth equity firm intends to enhance its portfolio company support and broaden its global network

Andera Partners holds EUR 450m first close for Andera MidCap 5

Vehicle has a target of EUR 600m and is around 50% larger than its predecessor, Winch Capital 4

Bravo Invest reaps 3x, 4.5x MM apiece in Arbo and MTW exits

With sales of Italian portfolio companies to NB Renaissance and DBAG, respectively, Bravo’s debut fund has now conducted four exits