Healthcare

MTIP holds USD 250m final close for second fund

Health technology firm has made five deals from the fund and expects to back 10 companies in total

Apax sells Unilabs to AP Moller

Laboratory and imaging diagnostics service is valued at more than EUR 5bn

Vivalto Partners buys majority stake in Vivalto Santé

New investors IK Partners and Hayfin are backing the deal, as well as incumbents such as Mubadala

VCs in USD 156m round for Quell Therapeutics

Series B for the Treg therapy developer was led by VCs including Jeito Capital and Ridgeback Capital

PAI, OTPP join forces in final leg of Veonet auction

Consortium may be well placed to clinch a deal for the Nordic Capital- and Palamon-backed ophthalmology group

First bids due for TA's Laboratoires Vivacy

TA Associates made an undisclosed investment in Vivacy in 2019

Capiton holds EUR 504m final close for sixth fund

Capiton VI is now 36% deployed across seven deals and expects to make up to 15 platform investments

IK, Asian strategics in final sale round for Schwind

Sell side is aiming to deliver on high price expectations for the asset

G Square transfers ISPS to new fund after sale talks with PAI collapse

Sponsor refinanced the business with incumbent lender CVC and another direct lender as part of the transfer

ArchiMed buys Cardioline

Cardiology telemedicine platform is the first deal from the GP's EUR 650m MED III fund

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan У kesson and head of IR AdalbjУЖrn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans

Adelis III holds EUR 932m final close

Stockholm-headquartered GP's predecessor fund held a final close in 2017 on EUR 600m

EQT acquires LSP, forming EQT Life Sciences

Announcement follows Life Sciences Partners' seven-month, EUR 850m fundraise for LSP VII

PAI exits Atos Medical in EUR 2.2bn trade sale

PAI acquired the laryngotomy and tracheostomy care products company in an SBO from EQT in 2017

Ardian, Latour buy LBO France's Groupe RG

LBO France bought a majority stake in the personal protective equipment producer in 2017

ArchiMed's MED II fund fully invested following Cube buyout

Cube is the last platform investment for the MED II fund, which closed in 2017

HealthCap looks to future growth after new appointments

Venture capital firm HealthCap is looking ahead to a busy healthcare and life sciences market

GHO appoints new director of sustainable investing

GHO creates the new role in order to further institutionalise its commitment to ESG

Aurelius buys McKesson UK in GBP 477m deal

Carve-out of McKesson UK includes LloydsPharmacy and is Aurelius's largest deal to date

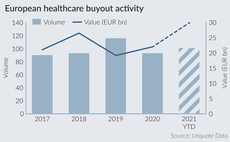

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

LBO France holds EUR 155m final close for Digital Health 2

GP previously raised EUR 70m for SISA, a fund dedicated to healthcare technology

Sofinnova holds EUR 472m final close for Capital X

France-headquartered VC will continue to focus on early-stage healthcare investments

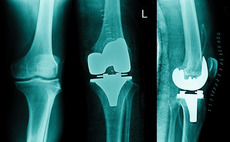

EQT launches LimaCorporate sale

Teasers for the Italian orthopaedic prosthetics producer were dispatched recently, sources say

Vendis puts Sylphar on the market

Private equity firms are looking with interest at the asset, one source says