Healthcare buyouts approach record EUR 30bn in 2021

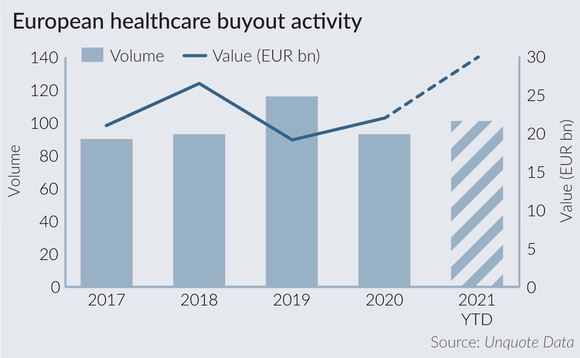

Private equity healthcare buyouts recorded so far in 2021 have reached a record aggregate value of EUR 29.9bn, according to Unquote Data.

The 101 deals recorded to far is second only to 2019, which saw 116 deals recorded, and this volume high point could well be exceeded before the end of the year.

By volume, 41% of the healthcare buyouts completed in 2021 so far have been for healthcare providers, such as oncology clinic chains and specialist care homes. These held a similar market share in 2020, when it stood at 44% across the full year.

Unquote and Mergermarket reported in September 2021 on the dynamics at play for private equity investment in the UK social care sector following the government's proposed social care levy. Although market sources were positive about demographic trends and additional government financing driving activity in the sector, they acknowledged that there was progress to be made when it came to wages and working conditions for carers, as well as the integration of data and digitalisation in the sector.

The UK and France have been the most active regions for healthcare buyouts by volume so far, with 24% and 23% of activity respectively.

However, the French market has been the source of more than half of the European PE market's aggregate healthcare buyout value (51%, EUR 15.3bn) in 2021 to date. This was driven by France seeing the three highest-value healthcare buyouts recorded in 2021: EQT's EUR 4.5bn secondary buyout of clinical pathology specialist Cerba HealthCare from Partners Group; BNP Paribas, ICG and Merieux Equity Partners' EUR 4.3bn acquisition of nursing home chain Domus Vi; and CVC Capital Partners' acquisition of over-the-counter (OTC) self-care pharmaceuticals producer Cooper Consumer Health in a EUR 2.2bn SBO from Charterhouse.

Healthcare-focused buyout funds raised in 2021 include GHO Capital's third fund, which held a EUR 2bn final close in July 2021, as reported. Meanwhile, ArchiMed announced in August 2021 that it had raised EUR 650m in a two-month process for its small-cap MED III fund, as reported.

Processes currently underway in the healthcare sector include EQT's sale of Italy-based orthopaedic prosthetics manufacturer LimaCorporate, according to Unquote sister publication Mergermarket. Further processes that could attract sponsor interest include France-based veterinary clinic chain VetOne, which is up for sale in a process run by Natixis Partners, according to Mergermarket.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds