Healthcare

Trilantic invests in Smile Eyes

Trilantic intends to pursue a buy-and-build strategy for the German ophthalmology clinic chain

GHO holds EUR 2bn final close for third fund

Fund close follows a fully virtual fundraise that saw the GP surpass its EUR 1.25bn target

EQT's Cerba buys Lifebrain from Investindustrial

Parties agreed on a price of more than EUR 1bn, with exclusivity awarded last week

Panakès Partners holds EUR 150m first close for second fund

Vehicle's target has been extended to EUR 180m and the fund will focus on medtech and biotech deals

Investindustrial's Lifebrain nears sale to Cerba HealthCare

Parties are in final-stage talks, with signing set to take place in the next couple of days

BC sells Pharmathen to Partners Group in EUR 1.6bn deal

BC Partners acquired the Greece-headquartered generic pharmaceuticals developer in 2015 for EUR 475m

WestBridge exits AJM Healthcare to Livingbridge

WestBridge backed the MBO of the wheelchair and mobility service provider in September 2018

Montagu acquires Intech from Eurazeo

Eurazeo says it is set to achieve a cash-on-cash multiple of 3x and an IRR of 31%

EQT sells Igenomix in €1.25bn trade sale

Igenomix had a €400m enterprise value at the time of EQT's initial investment in 2019

British Patient Capital launches £600m life sciences programme

Programme will invest in later-stage life sciences funds targeting at least ТЃ250m

Bridgepoint backs PharmaReview

GP is investing via its first Growth fund, which makes investments of up to ТЃ15m

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

EQT to sell Fertin Pharma to Philip Morris

EQT exits the company four years after it acquired a 70% stake in it from the founding Bagger-SУИrensen family

Carlyle injects €60m into Inova

GP invests via Carlyle Europe Technology Partners IV, a €1.4bn fund closed in 2019

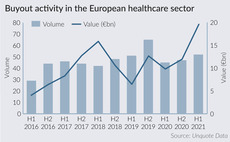

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

Phoenix confirms Sygnature sale to Five Arrows

Deal is the third strong exit from Phoenix's 2016 fund, following Travel Chapter for 3.6x and Rayner for 4.3x

SoftBank leads $600m series-D for CMR Surgical

Series-D values the business at around $3bn, according to an FT report

ArchiMed buys Stragen Pharma

GP is investing via its €1bn Med Platform I, which backs healthcare firms with EVs of at least €100m

High-Tech Gründerfonds to launch fourth seed fund

Fund expects to launch its official fundraising process in September 2021, subject to BaFin approval

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

ABN Amro launches €425m Sustainable Impact Fund

Fund will make PE and VC investments in the Netherlands and neighbouring countries

Hannover Finanz buys majority stake in Dental Direkt

GP has acquired a 64% stake in the dental laboratory supplier as part of a succession solution

Palatine holds £220m final close for fourth fund

Vehicle is similar in size to Palatine III and has made four investments as of its final close

Palatine buys majority stake in KCP-backed Routes Healthcare

Key Capital Partners will retain a minority stake in the company, which it first backed in 2016