Healthcare buyout value hits new high in first half

Healthy amounts of dealflow and a trio of mega-buyouts have pushed the aggregate value of buyouts in the European healthcare sector to nearly тЌ20bn in the first half of 2021, confirming strong appetite for the sector amid the fallout from the pandemic. Greg Gille reports

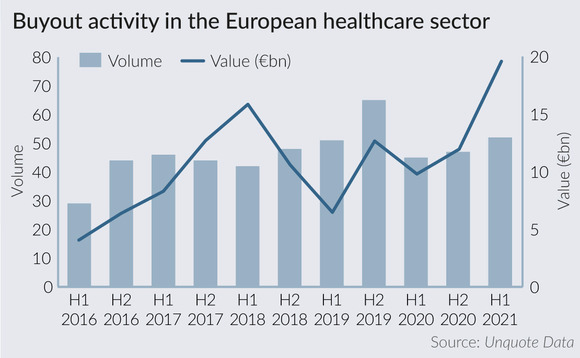

Unquote has so far recorded 52 buyouts for European targets in the healthcare sector in the first half of 2021, tallying up to an estimated aggregate value of €19.5bn. In the previous half, the figures stood at 47 deals for a total of €11.9bn.

With the potential for more (albeit small) deals to be uncovered through secondary research in the coming weeks, the volume total could conceivably approach the high-water mark of 65 deals seen back in H2 2019. It is already the second highest half-yearly deal volume recorded over the past 10 years, just edging the 51 deals inked in H1 2019.

In any case, the aggregate value is the highest ever recorded in a single half-year by Unquote, surpassing the previous high of €15.8bn seen in H1 2018.

This was both a factor of the uptick in deal volume and of a handful of very sizeable deals inked over the past six months. Chief among these was the €4.5bn acquisition of French medical business Cerba HealthCare by EQT from Partners Group. H1 also saw a €4.3bn buyout for French nursing homes operator DomusVi, while Charterhouse sold Cooper Consumer Health, a France-headquartered provider of generalist over-the-counter self-care pharmaceuticals, to CVC for €2.2bn.

Healthy dealflow in the mid-market also contributed to the flattering value total, with deals including Ardian selling French orthopaedic equipment manufacturer Lagarrigue Group to Naxicap Partners. Meanwhile, Phoenix Equity Partners achieved a couple of successful SBOs in quick succession in recent days: the GP signed an agreement to sell medical supplies business Rayner Surgical Group to CVC; then sold its minority stake in Sygnature Discovery, a UK-based drug discovery firm, to Five Arrows Principal Investments in a deal valuing the business at £300m.

The latter deal valued Sygnature at 20x its £15m EBITDA, according to several sources speaking to Unquote sister publication Mergermarket. With the most coveted assets easily commanding high-teen multiples, healthcare has recorded a steady increase in its pricing. Entry multiples for healthcare assets climbed to 12.6x in Q4 2020 and reached 13.7x in Q1 2021, according to the latest Clearwater International Multiples Heatmap, which likely further fuelled the uptick in aggregate value seen in H1.

"The anti-cyclical nature of healthcare and the underpinned government funding in some healthcare segments will continue to generate interest across the industry, with multiples holding up over the next 12 months," said Ramesh Jassal, international head of healthcare at Clearwater, in the report. "We expect to see intense activity, especially from PE players, which are likely to increase their allocation towards the industry even further. Healthcare is currently one of the hottest sectors in the market and competition will remain high in the coming quarters."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds