Healthcare

SHS buys healthcare service Medigroba

SHS acquires Medigroba alongside two private investors, who will take over the company's management

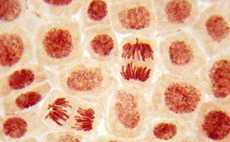

Wellington Partners leads €14m financing round for UroMems

Round includes €2m of funding from BPI France's PIA programme, adding to a €12m series-A

MIG in €1.3bn Ganymed trade sale

Private Equity fund MIG and VC Future Capital held minority stakes in the startup

MPM in iOmx Therapeutics' €40m series-A

Proceeds will be used to develop proprietary product candidates

Ysios et al. raise €15.5m series-B for CorWave

Backers include existing shareholders Sofinnova Partners, BPI France and Seventure Partners

IK acquires ZytoService from Capiton

GP hopes to build on its previous experience in the healthcare sector

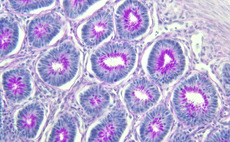

Mucap et al. in €10m Promethera series-C extension

Fresh capital will enable biotech company to invest in new product development

HealthCap et al. in SEK 327m round for Bonesupport

Round brings the total amount raised by the Swedish biotech company to more than SEK 750m

Caixa Capital Risc leads €1.5m round for Iproteos

Following the round, the company totals €3m of funding raised since its foundation in 2011

Nordic- and Avista-backed ConvaTec in £4.4bn IPO

Medical products company has been under the GPs' tenure for eight years

RJD acquires Barber from PHD and Enterprise

Deal represents 44.5% IRR for the vendors, four years after their initial investment

Palamon sells Sarquavitae to PAI portfolio company

Palamon reaps €140m in proceeds for a 3x money return following the sale to PAI

BC Partners buys 22 Priory Group clinics from Arcadia

GP acquires UK mental health facilities from the US group as part of regulatory compliance

GSO Capital, Siparex Intermezzo back Omega Group

M Capital Partners exits French nursing homes group after five-year holding

Chemelot leads €11m round for Fortimedix Surgical

Venture fund has been invested in the parent group of Fortimedix since 2004

Ratos-backed TFS acquires SCIderm

Acquisition comes after TFS and SCIderm entered into a strategic partnership in 2014

IK acquires German pharma group Aposan

Investment comes from IK Small Cap I Fund, which closed on €277m earlier this year

Nordic GPs look to new verticals in private healthcare

GPs in the region are increasingly turning to new healthcare subsectors as the private care segment evolves into a large-cap game

Life Sciences Partners in €17.5m Immunic series-A

Other participating investors included Bayern Kapital and High-Tech Gründerfonds

UK healthcare market still fighting fit post-Brexit

Momentous changes in the UK's healthcare provision space and the potential for growth in related subsectors present opportunities for private equity

SHS invests in spine implants producer EIT

Business hopes to use SHS's investment for an expansion to the US market

Inveready leads €3.5m round for Leukos Biotech

GP has drawn down capital from its Inveready Innvierte Biotech II vehicle

ArchiMed buys three French biotech businesses

As part of the deal, the GP has bought three French biotech businesses, Fyxteia, HIS and Polyplus

Imperial Innovations et al. in £25m series-A for Artios

Investment funds the spinout of the biotech business from Cancer Research UK