Healthcare

AshHill et al. invest in Heart Metabolics

US private equity firm AshHill Investments and Australian VC fund Trans Tasman Commercialisation Fund (TTCF) have invested $4m in London-based biotech company Heart Metabolics.

MVM leads $10m round for eZono

MVM Life Science Partners has led a $10m funding round for eZono, a German developer of portable ultrasound systems.

Mid Europa exits LUX MED

Mid Europa Partners has exited Polish healthcare provider LUX MED to Bupa in a deal which values the company at €400m.

EdRIP leads €13m series B round in Poxel

Edmond de Rothschild Investment Partners (EdRIP) has led a €13m series-B round for French biopharma company Poxel.

Arx Equity Partners sells Lexum to Moonray Healthcare

Arx Equity Partners has sold Czech ophthalmology and refractive surgery provider Lexum to British healthcare investor Moonray Healthcare.

PMV in €34.5m Biocartis series-D round

Flemish VC firm PMV has invested €11m in a €34.5m series-D round for Swiss molecular diagnostics company Biocartis, alongside other existing investors.

RCapital acquires Harley Medical Group

Turnaround specialist RCapital has bought UK surgery specialist Harley Medical Group from administration.

Sofinnova closes seventh fund on €240m

Sofinnova Partners has closed its seventh fund on the vehicle's €240m hard-cap.

VCs in £3.75m round for Bicycle Therapeutics

Biotherapeutics firm Bicycle Therapeutics has received ТЃ3.75m from existing and new venture capital investors.

Karmijn Kapitaal backs MBO of YouMedical

Karmijn Kapitaal has invested in Dutch medical equipment company YouMedical as part of an MBO.

Horizon Capital exits Fidem Life to Aegon

Horizon Capital has sold its entire stake in Ukranian life insurance company Fidem Life to Dutch asset management company Aegon.

EQT exits Gambro to Baxter

EQT and Investor AB have sold the remaining division of Swedish healthcare business Gambro Group to trade player Baxter International for SEK 26.5bn.

Metric Capital Partners invests in Centric Health

Metric Capital Partners has invested тЌ20m in the MBO of Irish healthcare provider group Centric Health and its two subsidiaries Уras SlУЁinte and Global Diagnostics.

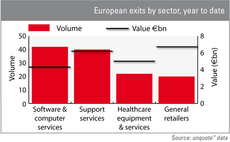

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

North West Fund for Biomedical backs TTS Pharma

The North West Fund for Biomedical has invested ТЃ550,000 in TTS Pharma, a UK-based developer of personalised nicotine patches for smokers.

Vesalius and SRIW lead €10m series A round in Euroscreen

Vesalius Biocapital Partners and SRIW have led a €10m funding round in Belgian pharmaceuticals company Euroscreen.

NGN Capital et al. in $40.3m Endosense series-C round

NGN Capital and a syndicate of existing investors have backed Swiss medical technology company Endosense with $40.3m in a series-C funding round.

InnoBio joins TxCell investors in third round

CDC Entreprises-managed InnoBio Fund has joined existing investors Auriga Partners and Seventure Partners in a €12.4m financing round for French biotech company TxCell.

BioGeneration and INKEF lead €4.8m round for Lanthio

BioGeneration Ventures and INKEF Capital have led a €4.8m series-A funding round for Dutch pharmaceuticals start-up Lanthio Pharma.

Blue Sea Capital acquires Dom Zdavlja Dr Ristic

Blue Sea Capital has acquired Serbian private healthcare clinic Dom Zdravlja Dr Ristic.

HTGF et al. back InnoCyte

High-Tech Gründerfonds (HTGF), the Mittelständische Beteiligungsgesellschaft (MBG) and Fraunhofer Venture have invested a six-figure sum in German medical device company InnoCyte.

21 Partners' Almaviva Sante acquires two French clinics

Almaviva Sante, portfolio company of 21 Partners, has acquired French private healthcare clinics Axium and Clinique Toutes Aures.

Capio buys healthcare division of PE-backed Ambea

Capio т a portfolio company of Apax and Nordic Capital т has acquired Carema Healthcare from Carema, the Swedish healthcare division of private equity-owned Ambea.

Wellington Partners leads series-C for Sensimed

Wellington Partners, Agate Medical Investments and Vinci Capital/Renaissance PME have invested CHF 17m in Swiss medical supplies business Sensimed.