Sector

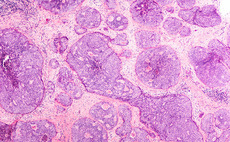

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

Enterprise Investors acquired a minority stake in the oncology company in 2013

Liberta Partners acquires Forteq Healthcare

Deal is a carve-out from Forteq Group and marks the fourth investment from Liberta Partners II

Cadence Growth Capital invests in PlusDental

Germany-headquartered dental platform is Cadence Growth Capital's third investment

LDC sells NBS to TA-, Stirling-backed Byggfakta

Bank of America was given the mandate to run the sale process for the company in September 2020

ProFounders leads €4.1m series-A for Nodalview

Company intends to use the fresh capital to scale up its team, while boosting its growth and expansion

Flexstone invests €6.3m in ProA-backed Pastas Gallo

With Flexstone's support, the business plans to further bolster its expansion, launch new products and boost its growth

Scottish Equity Partners invests in Dohop

With SEP's support, Dohop intends to scale up its team and expand its global sales

PAI-backed Stella Group buys BPE's DuoTherm Rolladen

Exit ends BPE's three-and-a-half-year holding period; the add-on is Stella's second under PAI

Axcel buys three staffing agencies

Combined group generates revenues of DKK 850m and employs 150 staff across 11 offices in Denmark

Chequers, Paragon to acquire Silverfleet's 7days

Sale process for the medical workwear company saw interest from FSN and Gilde, Mergermarket reported

VCs in €3.5m round for Cumul.io

Stijn Christiaens, co-founder and CTO at Collibra, will continue to act as an independent board member

EMZ Partners acquires Assepro

Buyout of the Switzerland-based insurance broker is EMZ's third DACH region deal of 2020

Abris Capital buys Scanmed for PLN 340m

GP invests in the company via Abris CEE Mid-Market III, which held a final close on its €500m target in 2017

H2 acquires Optegra

Vendor of the ophthalmology company is Eight Roads, Fidelity International's private equity arm

SR One set to deploy $500m fund following GSK spin-out

CEO Simeon George tells Unquote that the firm is seeing early-stage and later-stage opportunities

Waterland's Athera makes three bolt-ons

Germany-based physiotherapy group has made 11 add-ons since Waterland's investment in 2019

Permira's Exclusive Group bolts on Nuaware

Company has made add-ons in Europe, Canada and Hong Kong since Permira's investment in 2018

LDC sells Panther Logistics to trade

LDC's Midlands team originally invested in 2016 as part of a ТЃ17m management buyout

Alcedo buys Friulair

This is the ninth investment made by the GP via its Alcedo IV fund, which closed on €195m in May 2016

NorthEdge invests in Altia-ABM

Fresh investment from NorthEdge backs Altia-ABM's newly promoted CEO Rob Sinclair

Keyhaven sells PIC for 1.7x return

Keyhaven's latest direct investment fund was Keyhaven Capital Partners IV, which closed on ТЃ74.2m

BGF takes minority in Datum360

Datum360's fresh funding will be used to accelerate growth and address market demand

VCs in $125m round for Atai Life Sciences

Mental health treatment compound developer is backed by investors including

VR Equitypartner's Kälte Eckert buys SOS Kältetechnik

Refrigeration systems business has made three add-ons since VR Equitypartner's investment in 2017