Sector

EQT to sell Fertin Pharma to Philip Morris

EQT exits the company four years after it acquired a 70% stake in it from the founding Bagger-SУИrensen family

Carlyle injects €60m into Inova

GP invests via Carlyle Europe Technology Partners IV, a €1.4bn fund closed in 2019

Karmijn Kapitaal holds first close for third fund

Netherlands-headquartered GP held a final close for Fund II in June 2016 on €90m

Livingbridge buys majority stake in VC-backed Semafone

Octopus Ventures and BGF exit the data security and compliance software developer

Five Arrows invests £120m in Causeway Technologies

Deal follows the GP's ТЃ300m SBO of Sygnature Discovery from Phoenix Equity Partners

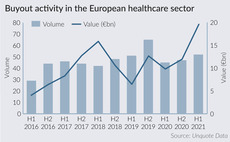

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

Altor buys Palette Software from Monterro

Monterro's exit comes six years after it acquired a minority stake in the company

Phoenix nets 4.3x return on sale of Rayner Surgical to CVC

CVC will deploy equity from its Fund VIII, which held a final close on ТЃ21.3bn

Phoenix confirms Sygnature sale to Five Arrows

Deal is the third strong exit from Phoenix's 2016 fund, following Travel Chapter for 3.6x and Rayner for 4.3x

Oakley to sell majority stake in Ace Education to trade

Exit will generate a gross return on investment of nearly 2.1x money and around 27% IRR for Oakley Capital Private Equity III

Hg, Vista Equity Partners to sell Allocate to trade

Sources told Mergermarket in May that the company could fetch a valuation of around ТЃ1bn

Cinven buys Arcaplanet from Permira in €1bn-plus deal

Pet care retailer reportedly fetched more than €1bn

SoftBank leads $600m series-D for CMR Surgical

Series-D values the business at around $3bn, according to an FT report

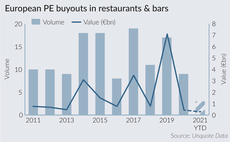

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Ares takes 33% stake in Atlético Madrid

Club shareholders unanimously agree to a €181m capital increase

Riverside buys Danish cybersecurity firm Cryptomathic

GP was supported by its institutional co-investors on the deal and plans to carry out add-ons in the cryptography space

Cross Equity, Pinova sell Rademacher to trade

GPs acquired the Germany-based smart home systems business in 2014 from Nord Holding

Klar to acquire Finnish installation company QMG

GP will merge QMG with its recently acquired Swedish portfolio company Sandbackens to create a new group

Perwyn buys majority stake in JT's IoT division

Jersey Telecom will retain a minority stake in the company, which is valued at ТЃ200m

ArchiMed buys Stragen Pharma

GP is investing via its €1bn Med Platform I, which backs healthcare firms with EVs of at least €100m

Altor, Goldman Sachs sell Navico to trade in €880m deal

Altor exits the company 15 years after creating the company by merging Simrad Yachting and Lowrance Electronics

Argand, Genui-backed Cherry to float in €778m IPO

Computer hardware firm was valued at around €200m when Argand took a majority stake in 2020

Graphite Capital sells Performance Timber to trade

Acquisition by Bergs Timber values the company at SEK 140m and ends a 12-year holding period

Leta launches $100m fund to back Russian-speaking founders

GP will focus on eastern European and Russian-speaking founders who it believes are undervalued and overlooked for funding