Sector

Balderton Capital leads $7.5m series-A for QuBit

Balderton Capital has led a $7.5m series-A round for UK-based customer data platform QuBit.

CD&R wins B&M Retail race

Clayton Dubilier & Rice (CD&R) has acquired a significant stake in the buyout of UK discount retailer B&M Retail, a deal rumoured to be valued around the ТЃ950m mark.

Iris Capital and Siparex invest €2.2m in V3D

Iris Capital and Siparex Proximité Innovation have invested €2.2m in French software developer Vision 360 Degrés (V3D).

Baird buys The SR Group

UK-based mid-cap investor Baird Capital Partners Europe has invested in The SR Group, a recruitment services firm.

Biffa: A rubbish buyout?

A rubbish buyout?

MML Capital exits MineTech

MML Capital Partners has sold its 40% stake in UK-based landmine clearance company MineTech to German trade buyer Dynasafe Area Clearance Group, which is backed by Perusa Partners.

NVM-backed Kitwave buys Teatime Tasties

Kitwave, a wholesaler backed by NVM Private Equity, has acquired Teatime Tasties, a wholesaler of biscuits, cakes, confectionary and soft drinks.

Lyceum's Access Group buys thankQ

Access Group, a business management solutions provider backed by Lyceum Capital, has acquired fundraising and CRM software specialist thankQ for ТЃ2.7m.

Beringea backs CognoLink

Beringea has invested in UK-based primary research firm CognoLink.

LBO France buys Alvest off AXA PE and Equistone

LBO France has acquired French industrial group Alvest from AXA Private Equity and Equistone.

Creathor et al. invest in Hojoki

Creathor Ventures and Kizoo Technology Capital have invested in German software start-up Hojoki.

DBAG increases Homag stake

Deutsche Beteiligungs AG (DBAG) has increased its stake in listed German portfolio company Homag Group AG from 33.1% to 39.5%.

Reiten exits Basefarm to ABRY

Nordic private equity firm Reiten & Co has sold Norwegian IT company Basefarm to US-based ABRY Partners.

Metric Capital Partners invests in Centric Health

Metric Capital Partners has invested тЌ20m in the MBO of Irish healthcare provider group Centric Health and its two subsidiaries Уras SlУЁinte and Global Diagnostics.

Principia backs MoneyFarm

Italian VC Principia has injected €2.65m into online investment advisory firm MoneyFarm.

Cabiedes & Partners leads funding round for Floqq

Cabiedes & Partners has led a €405,000 funding round for Madrid-based Floqq, an online education platform designed for those seeking employment.

Catella increases stake in IPM

Catella AB has increased its stake in investment services firm IPM Informed Portfolio Management AB from approximately 5% to 25% through a SEK 33m new issue private placement, conditional on an approved ownership assessment.

ICG backs MBO of ATPI from Equistone

The management team of UK-based travel management business ATPI has bought the company from Equistone with support from ICG.

Odewald & Compagnie sells mateco stake to TVH

Odewald & Compagnie (O&C) has sold its stake in German aerial platform provider mateco Gruppe to Belgian trade buyer TVH.

BGF backs Peyton and Byrne with £6.25m

The Business Growth Fund (BGF) has injected ТЃ6.25m into Peyton and Byrne, a London-based restaurant, retail bakery and events business.

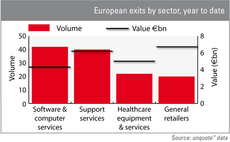

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

North West Fund for Biomedical backs TTS Pharma

The North West Fund for Biomedical has invested ТЃ550,000 in TTS Pharma, a UK-based developer of personalised nicotine patches for smokers.

Dunedin backs £34.5m MBO of Premier Hytemp

Dunedin has supported the MBO of Scottish oil and gas exploration equipment manufacturer Premier Hytemp from Murray International Holdings.

Ratos sells Contex to Procuritas for $41.5m

Ratosтs portfolio company Contex Group has signed an agreement to sell Danish Contex AS to the private equity fund Procuritas Capital Investor V LP for a total of $41.5m.