Sector

CVC & Vista head-to-head on Misys bid

Another bidder for FTSE 250 banking software company Misys has dropped out, leaving two private equity bidders in the race.

Reiten & Co acquires Con-Form

Reiten & Co has acquired a 62% stake in Norwegian prefabricated concrete manufacturer Con-Form.

Business Growth Fund invests £4.8m in Wow! Stuff

The Business Growth Fund has made its fifth investment with the purchase of a ТЃ4.8m minority stake in British toy company Wow! Stuff.

Alto Partners acquires Trevisanalat

Alto Partners has acquired Italian mozzarella producer Trevisanalat. The acquisition was completed through the formation of a newco, in which Alto holds a 77.2% stake.

Montezemolo acquires Bellco

Montezemolo & Partners SGR has acquired biomedical company Bellco from Argos Soditic and MPVenture.

Venture-backed Groupalia sells Latin American subsidiaries

Daily deals company Groupalia, owned by Nauta Capital, Caixa Capital Risc, General Atlantic, Index Ventures and Insight Venture Partners has sold its Latin American subsidiaries to local Brazilian daily deals site Pez Urbano.

Trade player considering rival bid for TPG target GlobeOp

Financial software and services company SS&C Technologies is set to outbid TPG Capital's offer for fund hedge fund specialist GlobeOp.

Nord Capital and Turenne back Kap Verre MBI

Nord Capital Partenaires, Turenne Capital and Alliance Entreprendre have backed the management buy-in of French glass specialist Kap Verre from its co-founders.

Denham Capital leads $190m FRV deal

Energy-focused private equity firm Denham Capital has led a funding round of more than $190m for Madrid-based solar company Fotowatio Renewable Ventures (FRV).

Main Capital sells Dutch software firm Tedopres to Etteplan

Main Capital has exited Dutch software company Tedopres after a six year holding period, completing its second exit in 2012.

Gimv leads €6m funding round in GreenWatt

Gimv, Innogy Venture Capital, SRIW and existing investors have committed €6m of capital to fund the expansion of Belgian alternative energy company GreenWatt.

Zurmont Madison acquires majority stake in AKAtech

Zurmont Madison Private Equity has acquired a 55% stake in Austrian electromechanical assembly and manufacture firm AKAtech Produktions.

Colony Capital completes PSG exit

Colony Capital has sold its remaining 30% stake in French football club Paris St Germain (PSG) to Qatar Sports Investments (QSI) in a deal that reportedly values the club at €100m.

Alven et al. in $5m round for Commerce Guys

Alven Capital and Open Ocean Capital have joined existing investor ISAI in a $5m round of funding for French e-commerce solutions provider Commerce Guys.

General Atlantic and Axel Springer set up €1.25bn joint venture

General Atlantic has invested €237m for a 30% stake in Axel Springer Digital Classifieds GmbH, a joint venture with German publisher Axel Springer.

Gresham-backed TTG bolts on Red-M

Gresham Private Equity portfolio company Team Telecom Group (TTG) has acquired wireless technology company Red-M.

KKR near final exit from Legrand

KKR has sold a further 12.7 million shares in listed French electrical equipment group Legrand, according to reports.

AAC Capital UK sells Amtico to Mannington Mills

AAC Capital UK has sold Amtico Group, an international designer and manufacturer of high end flooring, to Mannington Mills, a US-based provider of branded flooring products.

Chamonix and Electra acquire Peverel from administrators

Chamonix Private Equity and Electra Partners have announced a ТЃ62m acquisition of property management services company Peverel Group from administrators Zolfo Cooper.

FF&P backs MBO of British company CreditCall

FF&P and Bestport Ventures have taken a majority stake in British payment technology business CreditCall.

OEP buys Linpac Allibert

One Equity Partners (OEP) has wholly acquired Linpac Allibert, the returnable transport packaging business of Linpac Group.

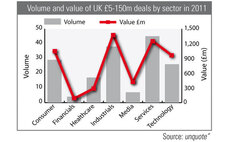

Business services keeps UK mid-market ticking

The UK's hugely important services sector remained key to the private equity market in the ТЃ5-150m segment. The 45 deals recorded in 2011 makes it easily the most important in volume terms, while its lower average deal size leaves it number two behind...

Apposite reaps 45% IRR on SureCalm exit

Specialist healthcare investor Apposite Capital has sold homecare services provider SureCalm Healthcare to medical technologies developer Amcare Ltd, reaping a 45% IRR.

HTGF leads series-A funding for Bonayou

High-Tech Gründerfonds and "make a startup angel fund" GmbH have invested in PL Gutscheinsysteme's non-cash-gift-voucher card Bonayou.