CEE buyout activity reaches six-year high

Buyout activity in the central and eastern Europe region reached a six-year peak in the first five months of 2017, with Poland leading the way. Kenny Wastell reports

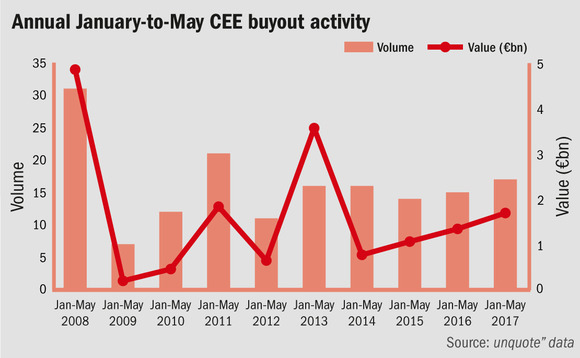

Buyout volume in central and eastern Europe reached its highest level in six years in the five-month period from January to May, according to unquote" data. There were a total of 17 deals in the region, the highest level of activity since the 21 recorded in the same period in 2011 and the second highest dealflow for the region since the financial crisis.

Aggregate value also saw a 26% year-on-year increase, reaching €1.7bn, compared with €1.35bn during the same period in 2016 and €1.07bn in 2015. However, the total amount of capital changing hands for assets within the region fell short of the €3.57bn recorded in the first five months of 2013. Yet this disparity is largely explained by VTB’s acquisition of Tele2 Russia for $3.6bn in 2013 – equivalent to around €2.74bn at the time.

In total, the CEE region accounted for 6% of total European buyout deal volume in the first five months of 2017, up from 5.1% year-on-year. Similarly, it also accounted for 3.7% of aggregate value across the continent, up from 3.2% in 2016. Speaking to unquote" in December 2016, Mid Europa Partners co-managing partner Robert Knorr said: "If you aggregate the transactions that have already happened in 2016, as well as what is coming up, there have been quite a lot of visible and large deals. This year [2016] has been extraordinary in that respect."

Notable deals within the CEE region since the start of 2017 have included Mid Europa's sales of Hungarian broadband and telephone provider Invitel to CEE Equity Partners for €202m and Polish supermarket group Zabka Polska to CVC Capital Partners. The latter deal is said to be the biggest Polish private equity exit of all time, with a source at the time telling unquote" it gave the company an enterprise value in excess of €1bn.

Despite the two impressive secondary buyouts of Mid Europa's portfolio companies, the total number of SBOs in the region saw a dramatic drop compared to the same five-month period in 2016. There were a total of three SBOs from January to May 2017, compared to nine in 2016. Yet the level seen in the first five months of 2016 was more than double the number recorded in the same period of any other year over the past decade. Primary deals in the region, on the other hand, reached a total of 14, the second highest level over the past six years and more than double the six recorded from January to May 2016.

Poles apart

Poland was the most active country in the region for the third year running, with a total of eight deals valued at €1.27bn in the five-month period. This accounted for 74% of aggregate deal value in the region, though this share is almost entirely accounted for by the two aforementioned Mid Europa exits. Dealflow in the country has increased in each of the past three years from two deals valued at €4m in the first five months of 2014, to five deals valued at a combined €274m in the same period in 2015 and six valued at an aggregate €352m in 2016.

Russia has only recorded one buyout in 2017 to date, with UFG Private Equity becoming the majority shareholder in the new company created by the merger of Russian online taxi aggregators Rutaxi and Fasten. Yet this marks the first private-equity-backed buyout in the country during the January to May period since Da Vinci Capital Management acquired a 63% stake in Russian online broker IT Invest in February 2014. Practitioners in the country might well be encouraged given Russian private equity’s struggles since the EU and US put in place sanctions against the country after the annexation of Crimea.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater