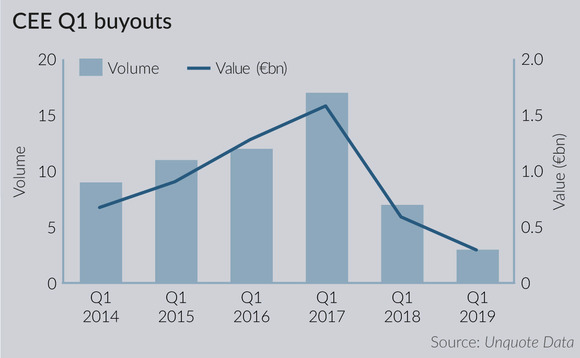

CEE buyout market picks up after record low in Q1

The CEE buyout market is showing signs of a recovery in the second quarter of 2019, after recording the lowest dealflow in terms of both the number of deals and the volume of capital invested in Q1. Oscar Geen reports

Seven deals had been completed in April and May as Unquote went to press, with just over six weeks of the quarter remaining. This level of investment puts the quarter on course to surpass 2018's nine deals, but is still a drop from the record highs of 15 buyouts in 2015 and 2016.

The weak first-quarter performance was already predicted early in the year by Matthew Stassberg, a partner at Mid Europa Partners, when speaking to Unquote for the 2019 Annual Buyout Review: "Sometimes you get these abnormalities where there is a spike in macroeconomic performance, but then people refuse to transact unless you agree to crazy valuations."

Economic growth in the region was very strong and unemployment low in 2018. Poland's economy was expected to grow by 4.8% last year in the European Commission's autumn forecast. It also forecast growth of 3.6% in Romania and fast growth in the Baltic countries. However, this economic growth was said to inflate the pricing expectations of some business owners, as Małgorzata Bobrowska-Jarzabek, a partner at Poland-based Resource Partners, said: "Entrepreneurs were reading about record-high multiples in western European buyouts. A lot of dialogue was impacted by that."

The phenomenon of high pricing expectations puncturing dealflow has been observed across Europe, and was the leading topic of the latest Unquote Private Equity Barometer, published in association with Aberdeen Standard Investments – but it was seen most sharply in the DACH and CEE regions. However, after a quarter of very few transactions, the deadlock seems to have been broken to some extent.

Local players

One of the deals completed so far in Q2 was Apax Partners' acquisition of Baltic Classifieds Group, which is so far the largest deal during the quarter. The Baltic private equity scene is somewhat differentiated from, and uncorrelated with, the rest of the region. Nonetheless, it was Apax's first deal in the Baltic states and only the second in the CEE region as a whole; the GP said at the time that it was confident in the growth prospects of the region and impressed with its business friendliness, pragmatism and entrepreneurial culture.

However, other than the Apax deal, all the buyouts took place in the Czech Republic, Poland and Croatia, and all were completed by local private equity firms, as Jet Investment, Value4Capital, Fenestra, Mid Europa Partners, Espira Investments and Innova all transacted in April and May.

A partner at one of the above firms, speaking off the record, said: "We are busy with a good but competitive pipeline. However, doing nothing also remains a strong option for a lot of the companies we see – they are growing and profitable, so the owners really can hold on."

In addition to the buyout transactions, the region has seen two other significant investments from international investors. On 8 May, digital healthcare booking platform Docplanner raised the third largest Polish venture round ever, with an €80m series-E led by Goldman Sachs Private Equity and One Peak Partners. A week later, Blackstone purchased a minority stake in Romanian sports betting website and online casino Superbet, using its Tactical Opportunities fund.

Both of these investments capitalise on the trend of increasing demand for technology platforms that afford greater convenience to consumers, which Resource Partners' Bobrowska-Jarzabek described as "under-developed in Poland compared with western European markets".

In total, non-buyout transactions made up an aggregate value of €310m over seven transactions. With pricing still high across Europe, these deals could increase as a proportion of total dealflow as GPs use minority and growth capital transactions as a way to bridge the gap between business owners' expectations and their own willingness to deploy capital in current conditions.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds