Encouraging signs of recovery in CEE

Private equity buyout volume and value in central and eastern Europe are on track to surpass 2014’s performance, but the market still lacks the mega-deals seen before the financial crisis. Mikkel Stern-Peltz reports

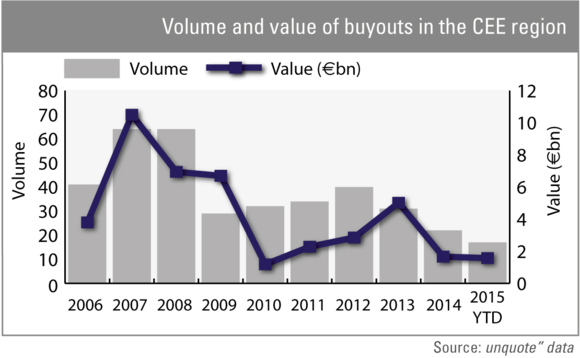

With 18 deals worth a total of €1.5bn, 2015 has been a decent year for the CEE region so far. If the market follows the trend this year, it will be on course to outperform the meagre dealflow seen in 2014, the worst year on record since 2010 – which itself was the worst in a decade, according to unquote" data.

Last year there were 22 deals totalling €1.6bn and it would require the Russia-Ukraine crisis spreading to the rest of the region or a massive economic downturn to knock 2015's private equity performance off its current strong trajectory. By mid-August, CEE buyouts were just €700m and 12 deals behind the 2011 figures for the region and it is not unimaginable that 2015 could near the €2.8bn's worth of deals recorded in 2012.

But the market is yet to see a single deal worth in excess of €400m this year – the largest three being CVC's €337m buyout of energy supplier PKP Energetyka, Pamplona's €315m deal for Partner in Pet Food, and the €250m acquisition of Slovenian Bank Nova KBM by Apollo and the European Bank for Reconstruction and Development.

Chasing records

In comparison, the record years of 2007-2009 were characterised by several deals in the €1bn+ segment, which have been largely absent ever since. Though it is tempting to suggest the times of billion-euro deals in CEE are over, the spectacular private equity activity of 2013 was largely propped up by two deals which made up €3.7bn of the year's €5bn total deal value.

Furthermore, a deal in the billion-euro buyout bracket is not unthinkable this year, considering the recent trend of private equity targeting government assets up for privatisation.

Cinven's bid for Slovenian telecoms company Telekom Slovenije was reportedly around €620m and, although it was ultimately withdrawn, that deal alone would have put 2015 deal value on par with 2011, if a buyer was found before the end of Q4.

Additionally, the Slovenian government's sovereign holding vehicle is yet to sell several of the 15 state-owned assets marked for privatisation, including national airline Adria Airways and Ljubljana Airport.

Production resurrection

While the current conflict with Ukraine means Russia is unlikely to contribute to buyout activity in any meaningful way, deals in the CEE region's mid-market may be an attractive play as capital retracts from emerging markets in the Far East.

Western European companies have favoured the likes of China and Bangladesh when outsourcing production in the past decade, but more recently some have been bringing production closer to home – either to their home countries, or to countries in the CEE region.

As AHV Associates director of M&A Omiros Sarikas recently told unquote", China and India no longer offer a more affordable workforce. Though Sarikas was referring to Greece, Danish lighting system manufacturer Martin has moved production from China to Hungary and many other European companies are making similar changes.

The move can be attractive to production businesses selling mainly to western European markets, which can cut the six-week shipping time from China to Europe to a few days from countries in the CEE region. A move to within the European Union also cuts environmental, social and corporate governance risk substantially, which is an ever-increasing focus for investors.

Money to burn

The final point in favour of a 2015 buyout boom is the amount of dry powder GPs targeting the region are currently sitting on. Last year, more than €1bn of commitments were raised by funds investing in CEE, in addition to €650m for Russia- and CIS-focused vehicles.

A further €115m was raised in August, with Genesis Capital launching its fourth fund with a €45m close and newcomer Livonia Partners holding a €70m first close for its maiden vehicle focused on Baltic businesses.

Though the region remains under-served, 2015 may yet turn out to be the year central and eastern European private equity regains some of the momentum lost in the financial crisis.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater