DACH fundraising picks up steam after slow Q1

Despite historically high fundraising over recent years, the DACH private equity market still struggles to fulfil the potential of Europe's largest economy. Gareth Morgan explores the hurdles it faces

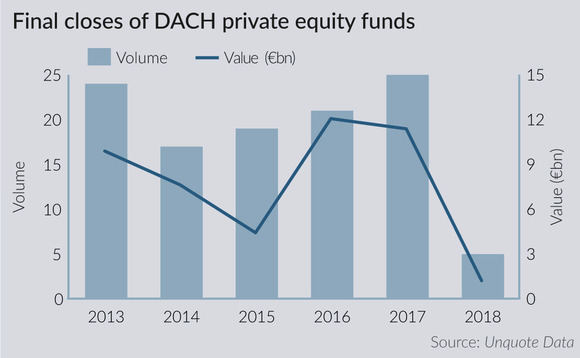

Private equity fundraising in the DACH region continued to build on strong momentum in 2017, with 25 funds holding a final close during the year securing a total of €11.37bn, according to Unquote Data. This total is a slight dip on 2016's €12.05bn, but does represent the second strongest year on record.

The largest fund to close was Partners Group Direct Equity 2016, which closed on €3bn in July, followed by Rocket Internet Capital Partners, which hit its $1bn hard-cap in January, and the Asia-Germany Industrial Promotion Capital Fund 1, which also raised $1bn holding a final close in February. The largest fund targeting solely the DACH region to close during the year was Deutsche Private Equity's DPE Deutschland III, which hit its €575m hard-cap in January, an increase of 65% on the GP's previous offering.

2018 got off to a relatively slow start in Q1, with five funds holding a final close raising €1.21bn. The largest of these was SwanCap Opportunities Fund III, which hit its €433m hard-cap in February, and had already deployed around half of its total capital, having completed 20 deals before final close.

Encouragingly for the German private equity market, the remaining three quarters of the year look set to be much more active in the fundraising space. Since the end of Q1, five funds have held final closes, securing €1.66bn, more than doubling the total amount raised for the year.

In addition to this, Unquote Data currently tracks 33 funds either currently raising in the market or about to come to market before the end of the year, targeting a cumulative €14.05bn. The largest of these is Triton's latest offering, which is understood to be targeting €3bn, launching in Q3 2018. There are three other €1bn funds upcoming: Capvis Equity V, which is understood to be due to close imminently, DPE Deutschland IV, to launch in Q4 2018, and Bregal Unternehmerkapital II.

Underperformance

Historically, the German private equity market has struggled to punch its weight in comparison with its European neighbours. "If you look at the PE penetration in the region, it's still significantly below its potential and also below other markets," says Christian Böhler, partner at Unigestion. "The number of deals is still relatively low given the size of the economy."

Over the last five years, German buyout deal value as a percentage of GDP has risen from 0.64% to 0.77%, up 19%, where over the same period this number for the UK rose from 1.37% to 2.21%, an increase of 61%, and France from 0.8% to 1.39%, up 73%. Of the 10 largest EU economies, just Finland posted a lower increase in deal value as a percentage of GDP, a fall of 57%. Looking at buyout fundraising as a percentage of GDP paints a similarly torpid picture for Germany, where this number fell 61% from 2013 to 2017, again the second worst number among the EU's 10 largest economies.

Culturally, financial sponsors have not always been seen in the best light, particularly in Germany, where Franz Muntefering, leader of the Social Democratic Party, referred to private equity companies as "locusts" in a 2005 interview. The following year, Der Spiegel, a prominent German publication, ran an article entitled "Private equity firms strip mine German firms", which spoke of companies "falling victim" to private equity owners.

UK entrepreneurs want to ultimately sell their business to PE and get rich, which contrasts with the DACH model of family ownership, succession, and socially responsible business ownership" – Christian Böhler, Unigestion

With recent coverage of the industry in Der Spiegel striking a far less damning tone, it's fair to say that this view has softened somewhat over time, but the industry still faces issues. "Basically, PE is not a German concept," Böhler says. "It's less in the blood of the people compared with the UK or France. Entrepreneurs in the UK want to ultimately sell their business to PE and get rich, which contrasts with the typical DACH model of family ownership & succession and socially responsible business ownership." One adaptation the PE market has made to adapt to accommodate this model of business ownership is the adoption of alternative fund models, explored in detail later in this report (see page 10).

This lack of penetration has resulted in what, in comparison to the rest of Europe, has been less than impressive performance. "In general, PE in the DACH region has not overperformed over the years but it has been a solid midfielder," says Böhler. "The two main reasons for that are there is a bit more volatility between fund managers than in other markets and also the sophistication of the average fund manager is a probably bit behind the most mature markets."

In some ways, the German fiscal environment can hamper managers, since there is a potential tax liability for a fund deemed to be carrying on a business or trade, and so managers can often be more reluctant than those elsewhere in Europe to be too operationally hands-on with portfolio companies. "How intensively and usefully the average DACH Mittelstand-focused PE firm engages with portfolio companies isn't as developed as counterparts in other markets," says Karl Adam, managing director at Monument Group. "However, we are seeing a few GPs break the mould, and actively seek out and adopt best practices."

Playing to win

Competition has also impacted performance for DACH managers operating in the upper end of the mid-market. Pan-European firms are often active in bidding for larger DACH assets, and this competition is increasing with regional managers, particularly from the Nordic region that have outgrown local markets looking at DACH as a fertile ground for capital deployment. Says Unigestion's Böhler: "Deals at this end of the scale are typically fully auctioned and get offered to buyers from across the world, so there's only a limited strategic advantage to being a local manager."

From the point of view of an LP, the variability in returns among DACH managers makes selection more crucial than usual. "It is possible to find DACH-focused GPs with consistently good track records, and the potential to deliver these going forward," says Monument's Adam. "Groups that have a source of differentiation - such as flexibility to take minority stakes, which can help to overcome family business owners' reticence about selling a controlling stake - should be well positioned."

Although the DACH PE industry continues to develop, it still faces stumbling blocks when it comes to catching up with more mature markets elsewhere in Europe. "On the timeline, PE in the DACH region is probably one generation behind most mature markets," Unigestion's Böhler says. "15 years ago people believed it would catch up very quickly, but this never really happened. There are still certain hurdles to overcome – both cultural as well as in the financing/banking landscape."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds