Austria: High PE demand held back by lack of funds

While investors in Germany are experiencing a lack of companies willing to sell in the primary market, the situation in Austria is quite the opposite. An increasing demand for equity stands against a small pool of funds. Diana Petrowicz investigates.

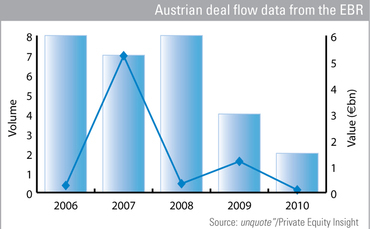

The Austrian private equity market was seriously affected by the economic crisis. Total buyout deal value fell from €5.2bn in 2007 to just €101m in 2010. Meanwhile, deal volume has halved each year between 2008 and 2010.

Changes in banking regulation, such as Basel III, will further complicate the situation for those companies seeking equity investment. Austrian mittelstand companies looking to expand in the near future will struggle to get hold of fresh capital. Kurt Stiassny, CEO of the Austrian private equity firm Buy Out Central Europe, thinks that funding from banks will decrease "as banks are now more careful and restrictive". These developments could result in a higher demand for equity capital.

Other ways for companies to raise funds, such as through an IPO, are currently out of reach for many. Stiassny says: "The IPO market is not quite back to full strength yet. I don't think that there will be many IPOs this year, therefore equity is only available through private equity investors."

The problem is further exacerbated because many private equity funds are themselves struggling to raise capital, as the local market is affected by a lack of fundraising sources. "Because of strict financial regulations, insurance companies and banks are not very active in the private equity fundraising scene," explains Stiassny. As the number of larger LPs is limited, GPs have to rely on family offices and endowments.

Low investment figures could also be attributed to the structure of Austrian companies. While Germany has many mid-size companies, firms in Austria are on average smaller, with a turnover between €15m and €50m. Small and mid-sized companies in Austria also rely on exports in order to expand their business. In the past, Austrian companies have increased their revenues through expansion into the Eastern European market. These proceeds have diminished and companies are now looking for capital to expand into upcoming markets such as South America and China, though this is expensive. While a small number of larger firms are receiving funding from international funds, the mid-market has to rely on local banks and investors, with restricted funding.

Asked if there will be enough funds this year for Austrian companies to expand their business, Stiassny says: "Yes and no. There are no large investors such as pension funds in Austria but endowments might provide the needed equity capital." He is also positive that, as demand for private equity rises and dealflow increases, the fundraising situation for GPs will improve as well.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds