Articles by Mariia Bondarenko

Baring Vostok, Vostok New Ventures sell Doc+

Baring Vostok Private Equity and Yandex provided $5m of financing to Doc+ in 2017

PE-backed Kaseya acquires Graphus

Insight Partners first invested in Kaseya in June 2013 and is the majority shareholder in the company

PFR cuts its stake in Enel Russia

Changes are related to the planned change in the ownership structure within Enel Russia's consortium of investors

Innova exits Trimo to trade

GP acquired the company in a 2015 buyout from a group of Slovenian banks, including Nova Ljubljanska Banka

Consortium in $100m round for Omio

Fresh capital will be used for organic growth activities and M&A opportunities

Global Brain extends series-A for Element Insurance

Global Brain is investing from its SFV GB Fund, a joint venture between Sony Financial Ventures and Global Brain Corporation

Genesis acquires Home Care Promedica

GP is investing from its Genesis Growth Equity Fund I, a vehicle that held a first close on €31m in 2019

Horizon leads $5m round for Liki24

Fresh capital will be used to finance the company's further expansion in Europe

DIF Capital invests €82m in Touax Rail

GP is currently investing from its 2019-vintage DIF Core Infrastructure Fund II

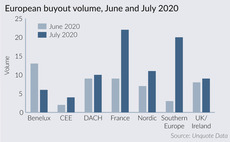

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

Heal Capital, EBRD in $10.25m series-A for Infermedica

Round also saw participation from existing investors Karma Ventures, Inovo Venture Partners and Dreamit Ventures

Horizon exits Glass Container to Vetropack

Glass Container companies are portfolio companies of Horizon Capital’s Western NIS Enterprise Fund

Peninsular backs NovaSparks MBO

GP will partner with NovaSparks CEO Luc Burgun to consolidate in a range of financial markets

Capital D sells Invincible Brands to Henkel

Capital D acquired Invincible Brands for an undisclosed sum in January 2018

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Fund+ leads €23m series-A for Exevir

Exevir will commit to the international effort to pursue new treatment for Covid-19

Blackstone-backed Superbet acquires Lucky 7

Blackstone acquired a minority stake through its Blackstone Tactical Opportunities Fund I in 2019

Consortium in $60m series-B for Withings

Withings plans to add 100 new positions in the US and France by the end of the year to strengthen its teams

Fund+ leads €38m series-B for Indigo Diabetes

Jan Van den Bossche, partner at Fund+, will join the board of the company

V4C-backed Kom-Eko buys Lubelska Agencja Ochrony Srodowiska

Value4Capital acquired Kom-Eko from Royalton Partners in November 2018 via its V4C Poland Plus Fund

Taxim acquires Doganay Gida

Under Taxim Capital's ownership, Doganay Gida plans to accelerate its growth

AddVenture, Target Global in $4.5m series-B for BestDoctor

Fresh capital will be used to develop BestDoctor's software and expand sales activity

EVentures leads $4m seed round for Sorare

Fresh capital will be used to scale up Sorare's team and finalise additional licensing partnerships

Keensight hires Jamin as director

Prior to joining Keensight Capital, Stéphane Jamin was a manager at Kearney