CEE Unquote

Atomico leads $11m series-A for Katana

Company intends to use the fresh capital to scale up its team, further develop its product and boost its expansion

Resource Partners acquires Polish company Nesperta

GP will help the company with its expertise and experience through international and product expansion

Flashpoint holds $70m first close for new venture secondaries fund

GP is targeting $200m for its new strategy, and its co-founders will commit 10-15% of their own capital to the fund

Zubr Capital, EBRD exit Targetprocess

Sale to Appito, a Vista Equity Partners portfolio company, is the first exit from Zubr's debut fund

Prime Fund aiming to close 10 new investments this year

Newly launched Czech technology fund is open-ended and aims to raise CZK 1bn in total

AnaCap sells Equa Bank to Raiffeisen Bank

GP says the digital bank had grown its deposit base and loan book by more than 12x and achieved 36x growth in revenues

Enterprise Investors completes PragmaGo take-private

GP plans to de-list the company from the Warsaw stock exchange "as soon as possible"

Genesis closes first growth fund on €40m hard-cap

Vehicle was launched in May 2018 and held a first close in October 2019

TEP Capital to build portfolio of six Polish investments

Poland-based TEP Capital was set up a year ago and is funded by German conglomerate Thomas Gruppe

Siena Venture targets €25m close before year-end

Debut fund from the new VC player held a first close on 1 February

Omikron buys Polish company Dagat ECO

GP invests in Polish SMEs, particularly production-based and services companies with scalable business models

Advent-backed InPost prices IPO at €8bn valuation

Company has been owned by Advent International, which acquired the company alongside its listed parent company Integer in April 2017

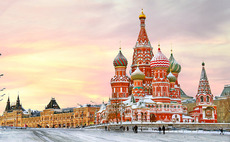

Elbrus holds first close on $260m for third fund – report

Fund has a target of $600m, which it plans to reach by next year, according to Kommersant

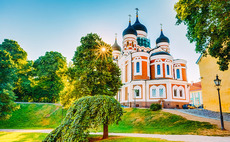

New Baltic fund targets €30m to back female founders

Fund targets Baltic and Nordic startups with female founders and gender-balanced executive teams

Learn Capital leads $80m series-D round for Brainly

Funds from the round will be used to bring new products to the Brainly community

D1 leads €150m round for Bolt

Bolt will use the funds to enhance the safety and quality of its products as it grows in Europe and Africa

Mid Europa to acquire Sage Group's Polish business

Software business is valued at £66m and the sale process saw interest from a number of sponsors

Enterprise Investors to carve out Software Mind from Ailleron

GP will deploy equity from its Polish Enterprise Fund VIII, which held a first and final close on €498m

Abris Capital buys Scanmed for PLN 340m

GP invests in the company via Abris CEE Mid-Market III, which held a final close on its €500m target in 2017

Innova acquires stake in Bielenda Kosmetyki

Proceeds from the investment will fund the company's acquisition of two cosmetics brands from Norwegian cosmetics group Orkla

FirstFloor et al. back €41m series-D for Skeleton

Latest round brings Skeleton's total funding to €93m since its inception in 2009

Mid Europa buys Polish e-retailer Displate

Company's founders will remain significant minority shareholders of the business

Abris exits locomotive leasing business Cargounit to Three Seas

Polish buyout firm Abris Capital Partners has signed an agreement to sell its stake in Polish locomotive lessor Cargounit, also known as Industrial Division, to Three Seas Investment Fund (3SIIF).

Innova to buy PayPoint's Romanian division

PayPoint will use the proceeds to focus on core UK markets