Unquote

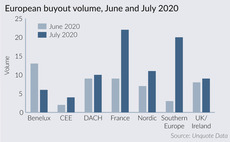

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

How the crisis could affect fund T&Cs

In a tough funrdriasing and deal market, GPs will be looking for all the incentives they can possibly provide

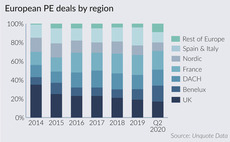

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

Unquote Private Equity Podcast: Calling tech support

This week, the Unquote Podcast talks all things technology with Intuitus chief commercial officer Adrian Astley Jones

Fashion victims: GPs face a tough year in the clothing & accessories sector

Unquote explores dealflow expectations and potential silver linings for the segment, which has been one of the hardest hit by the pandemic

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

PE secondaries volume cut by more than half in H1 - survey

Private debt fund secondaries were hit even harder with an 81.8% plunge, Setter says

Nuveen Global Impact Fund holds $150m first close

Fund invests in growth-stage companies in developed and emerging markets, with a focus on resource efficiency

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

Blackstone Life Sciences V closes on $4.6bn

Fund invests in late-stage rounds of established life science companies and emerging businesses

Download the July/August 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers, with some added interactive features

HIG Capital launches HIG European Capital Partners III

Fund will invest in buyouts, recapitalisations and carve-outs of both profitable and underperforming businesses

LP Profile: CPP Investments

Unquote picks out key takeaways from CPPI’s latest annual report, and hears from head of PE funds Delaney Brown about the Canadian LP's strategy

CPP Investments appoints SNCF's Pepy as senior adviser

Pepy joined SNCF in 1993 and served as chair and CEO from 2008 to 2019

Oddo BHF Private Equity Secondaries Fund closes on €358m

Oddo BHF Private Equity Secondaries Fund has a focus on secondary transactions ranging from тЌ5m to тЌ50m

CVC hits €21.3bn close for eighth buyout fund

Fund invests equity tickets in the range of тЌ200m-1bn in North American and European companies

B Capital closes second fund on $820m

Fund invests in series-B, -C and -D rounds to support B2B and B2C startups based across Asia, Europe and the US

Buy-and-build: 3i's five-step strategy

Pete Wilson, partner and head of UK private equity at 3i, outlines some key considerations for executing successful bolt-on acquisitions

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

PA SERS appoints Seth Kelly as new CIO

Kelly joins from the Missouri State Employees Retirement System, where he was also CIO