France, southern Europe drive dealflow uptick in July

The buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier in July. Mariia Bondarenko reports

After losing a great deal of momentum in Q2 2020, the buyout market has started overcoming the impact of the Covid-19 outbreak, according to Unquote Data.

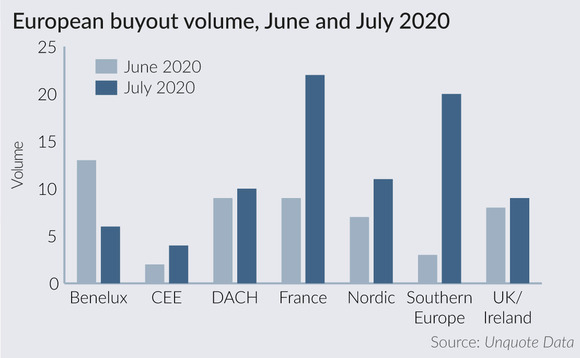

The preliminary figures for July indicate a sharp rebound in the number of PE deals announced. Total deal volume went up from 51 in June to 82 in July, an increase of 61% – although it has to be noted that this volume total is low compared to typical July periods in recent years.

Buyout activity rebounded or stayed nearly the same in all regions across Europe except for Benelux, where it actually fell by half. Meanwhile, the regions originally hit the hardest by the outbreak saw the sharpest rebounds in July. These include southern Europe, where deal volume increased from three transactions in June to 20 in July; and France, up from nine to 22, both reaching pre-crisis volume totals. The UK & Ireland, DACH and Nordic regions also had a more robust month, with a promising deal volume increase on the previous month, but buyout dealflow remained scarce overall. The UK was home to only eight deals in July, while Germany saw 10 transactions.

The large-cap segment woke from its slumber in France and Italy too, boosting the aggregate value figures seen in these countries in July. In the former, KKR and Ardian invested in Elsan, an operator of private hospitals and clinics owned by CVC Capital Partners; the deal gave the company an enterprise value of around €3.3-3.5bn, equal to almost 12x EBITDA.

Meanwhile, in Italy, BC Partners initiated a take-private for Milan-listed company Ima, a manufacturer of packaging machinery, in a deal valuing the company at €3.6bn.

The Nordic region also saw aggregate value spiking given TA Associates' acquisition of a minority stake in Sweden-based enterprise software provider IFS from EQT; the deal valued the company at in excess of €3bn.

All other regions remained weak in terms of aggregate deal value, with a noticeable drop on the previous month, further indicating that any activity recovery is likely to be driven by small-cap and mid-market deals for some time.

The smaller end of the European market did rebound in July, with deal volume increasing 66% on the previous month, while the mid- and large-cap segments remained even. Meanwhile, an increase in large-cap aggregate value (from €2bn to €11bn in July) significantly boosted the total deal value of the month.

Processes underway

According to Unquote sister publication Mergermarket, notable ongoing processes in Europe include:

Southern Europe

The Italian football league Serie A is to make a final decision on how to go forward with its TV rights. CVC has made a binding offer, while a consortium made up of Advent and FSI, and a solo bid from Bain Capital, have made what is described as quasi-binding offers. Offers for a 20-25% stake in a newco that will handle the TV rights values the newco at €13-15bn. In addition to offers for a minority stake, some PE firms have put forward financing proposals, including Apollo, Fortress and Blackstone.

UK/Ireland

Walmart has asked parties interested in buying its UK grocery division Asda to table second-round offers by early September. Walmart could get $10bn for Asda. Lone Star, TDR and Apollo each tabled bids for Asda earlier in 2020 and were permitted to take part in a second bidding round. However, Walmart shortly thereafter halted the sale process due to the Covid-19 pandemic, which led to heavy demand for some products.

DACH

Solvay is moving ahead with a process to sell a package of assets responsible for producing strontium carbonate, barium and sodium percarbonate in Germany. Lazard is working with the Brussels-headquartered chemicals giant on the disposals. The divisions generate EBITDA in the region of €20-30m.

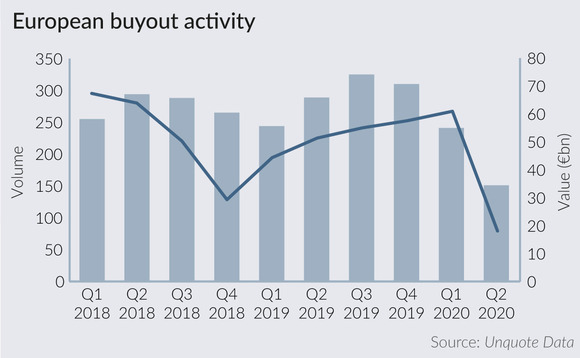

Q2 slump

Unquote's recently released Q2 statistics lay bare the impact that coronavirus has had on dealflow from March onwards. Dealflow dropped by almost 40% in Q2 and the value of transactions fell to less than one third of that seen in the previous two quarters.

In all, there were 151 buyouts announced between April and June, a 20-quarter low and a sharp drop from the 241 deals completed in Q1. As would be expected, it was the slowdown at the top end of the market that impacted overall buyout value the most. The quarter's four >€1bn buyouts were worth just €5.4bn, in sharp contrast to the previous quarter's €43.4bn. It was the lowest value in the last 10 quarters and took overall buyout value to €18bn from €60.9bn in the previous quarter. The weakness at the top of the market led to a fall of 53% on the previous quarter in average buyout value to €119.8m.

Almost all regions saw a sharp decline in activity in Q2, with the UK (down from 58 to 20), and France (down from 58 to 20), being the hardest hit. Of the main PE markets, the DACH region suffered the least, arguably helped by a robust crisis response from governments and an early return to business. Deal value also declined in most regions in Q2, rising only in the Nordic countries (by 47%) and Benelux (by 35%) on the previous quarter. Meanwhile, it decreased by 81% in DACH, by 67% in southern Europe, by 65% in France, by 59% in the UK & Ireland, and by 25% in CEE.

The largest buyout deals of the quarter included Permira and Warburg Pincus' minority investment in Tilney Smith & Williamson, a London-based wealth manager. The deal has been estimated to be valued at around €2bn, the largest transaction recorded by Unquote in Q2.

In May, Bridgepoint acquired a majority stake in French insurance broker Groupe Financière CEP from US-based investment firm JC Flowers and the company's founder. The deal valued CEP at around €1.3bn, equating to approximately 10x EBITDA.

BDT Capital Partners acquired a minority stake in London-based makeup and skincare company Charlotte Tilbury in an SBO from Sequoia Capital, Samos Investments and Venrex Investment. The financial terms of the transaction were not disclosed, but the deal reportedly valued the company at more than £1.2bn.

For a full breakdown of Q2 activity, including detailed regional statistics and growth/venture investment trends, look out for the upcoming Private Equity Barometer published in association with Aberdeen Standard

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds