Concerns over "unfair" Fondo Italiano

Italy’s Fondo Italiano has been on a roll in recent weeks, completing five deals in just seven days over the festive period. But mid-market professionals in Italy are concerned the government-backed fund could be introducing unfair competition. Amy King reports.

Since the announcement of a €1.2bn first closing was made in 2010 by Andrea Montanino of the Italian Treasury during his keynote speech at the unquote" Italia private equity congress, the Fondo Italiano di Investimento has completed 18 direct investments and nine investments in funds. But much like its UK counterpart, the Business Growth Fund (BGF), Fondo Italiano has come under fire for its potential to distort a local market. Many are concerned it is focused on an already well-populated segment of the industry, the mid-market.

The fund was launched by the Treasury department of the Italian Ministry of Economy and Finance as a response to the financial crisis. It aims to provide equity to Italian SMEs in industry, commerce and the service sectors to support growth and international expansion, boosting wider economic recovery. The four main contributors to the fund are Italian banks Intesa-Sanpaolo, UniCredit Group, Banca Monte dei Paschi di Siena and la Cassa Depositi e Prestiti, each of which has contributed €250m.

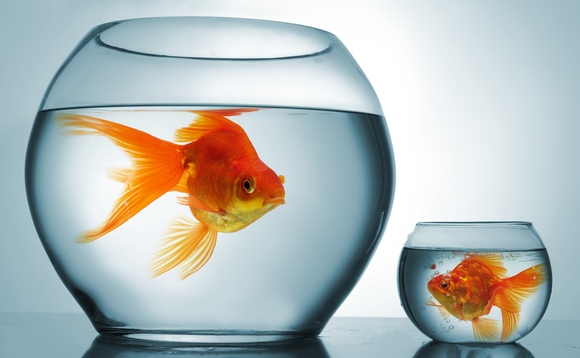

However, unlike the BGF, which focuses on very small businesses, the majority of the Fondo Italiano's activity will take place in the mid-market, where it will invest in companies with €10-250m turnover. Its focus is the segment of the market in which the most deal activity already occurs in Italy, prompting criticism that the Fondo Italiano is in fact a competitor to mid-market private equity companies - a criticism senior investment manager at the Fondo Italiano Lorenzo Carù confirms: "objectively speaking, we are a private instrument on the private equity market. We are therefore in competition with other funds." But with a €1.2bn balance sheet and government support, is this competition fair?

Not really, according to Gianluca Calise from mid-market private equity house Alcedo SGR. The private equity professional suggests that when it comes to direct investments the Fondo Italiano operates under more "relaxed" conditions than other private equity firms as a result of its above-average balance sheet, government backing and up to 15 year lifespan. These conditions, he claims, could be perceived as "slightly unfair". While Carù stresses the private nature of the vehicle and the capital it contains, the attainment of such a high figure at first closing seems questionable without the support and promotion of the Italian government. Indeed a final closing of as much as €3bn is expected.

However, Calise believes the Fondo Italiano does have a vital role to play as a fund-of-funds. Investor aversion to risk in the current economic climate and an unfavourable view of the Italian economy from abroad have made access to equity even harder. He suggests that the real strength of the Fondo Italiano lies in its potential to bridge this widening equity gap: "The Fondo Italiano has a very important part to play in its role as a fund-of-funds. Italy is suffering from the overly negative perception of its economy from foreign investors. Institutional investors are far less likely to invest in Italian funds, so in this sense the Fondo Italiano does bridge an equity gap."

Moreover, much has been made in the recent Italian press of the lack of funding for start-up companies, a domain traditionally associated with young entrepreneurs. As Calise expressed, venture capital funds could "play an important role" in rebuilding the economy. A boost in seed investments from venture capital funds might kick-start the careers of many young Italians and help reduce the high unemployment level for under 25s. Fondo Italiano's recent announcement that it will expand the remit of its investments to include venture capital funds was therefore warmly received.

It seems that in reality though the new announcement will have little bearing on the activity of the fund. According to Carù, "investments in Italian companies and growth capital funds, not venture capital funds, will remain the focus of the Fondo Italiano."

The public-private status of the Fondo Italiano is likely to remain controversial, particularly if it continues its focus on an area of the market which many believe has sufficient funding from private funds. However, with Italy facing extremely difficult economic circumstances, its role as a fund-of-funds and potential co-investor could provide a much needed lifeline to the country's private equity industry.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds