Ardian (formerly Axa PE)

Resource Partners, Ardian sell Delicpol to Continental Bakeries

GP sells its stake in the Polish biscuit maker after a five-year holding period

Ardian's Italmatch buys Magpie Polymers

Magpie was previously backed by Emertec Gestion via the Fonds Lorrain de Materiaux

BGF sells Chemoxy stake to Eurazeo-backed Novacap

Sale of speciality chemicals manufacturer comes just two years after the GP first invested

Ardian takes minority stake in Sarbacane Software

Third investment completed by Ardian Growth in the past two months, following Santédiscount and Abvent

Ardian purchases minority in T2O

Deal sees Ardian Growth acquire a minority holding in the Spanish business

Sofindev exits Syx Automations

Sofindev acquired Syx in 2013, drawing equity from its €50m third vehicle Sofindev III

Ardian sells Clip Industrie to Forterro

Ardian took a 15% stake in the company in 2013 through its Ardian Growth arm

Ardian sells majority stake in Irca to Carlyle

Ardian became Irca's majority owner in 2015, backing the company's MBO with a €230m investment

Ardian buys Dynamic Technologies

Ardian will acquire control of the business through its North America Fund II

Ardian invests in Abvent

Ardian invested through its Expansion Fund IV, which closed last year on €1bn

Ardian takes 60% stake in Global Product Solutions

Ardian invests through its mid-cap buyout arm, for which it recently closed Ardian LBO Fund V on €4.5bn

Ardian invests in Santédiscount

Ardian made the investment through its lower-mid-market arm Ardian Growth

Omnes backs Batiweb SBO

French GP secures a minority stake in the business while Ardian realises its 2008 investment

Ardian strikes $2.5bn secondary/primary transaction with Mubadala

Ardian takes majority stake in an existing PE portfolio and becomes lead investor in a new $1.5bn fund

Activa, Ardian and SocGen back HR Path OBO

Ardian and SGCP had already contributed a joint €5m expansion round in 2015

Ardian's Hypred acquires Paragon Partners' Anti-Germ

Transaction represents the first bolt-on completed by Hypred since Ardian acquired the company last year

Ardian's Trescal acquires Gebhardt

Trescal has completed around 20 bolt-ons in total since Ardian became majority owner in 2013

CVC purchases CLH from Ardian et al.

Deal is the fourth investment for the GP's 2016-vintage Strategic Opportunities fund

Contrasting fundraising fortunes in French mid-market

Numerous closes in Q1 and more on the horizon will give a clearer view of the French fundraising landscape

Deal in Focus: Ardian to take majority stake in Prosol

French hypermarket group reportedly valued in the region of €1bn, with existing investors remaining as minority backers following completion

Ardian's Solina buys Supremia

Ardian will continue its strategy of external growth in the European food industry through the acquisition

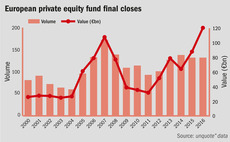

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

Ardian to acquire Prosol

Company founder Denis Dumont will reinvest in the group alongside the new majority shareholder

Ardian sells Frostkrone to Emeram

French GP exits its stake in the German forzen foods manufacturer after a four-year holding period