Barometer

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

Growth equity deals enjoy Q4 uptick

Growth capital investment activity recovered substantially in Q4 following a poor third quarter, but remains low compared to recent historical averages.

UK Watch: Large deals boom in 2012

The final quarter of 2012 saw the highest large deal volume since early 2010, according to the latest unquoteт UK Watch, in association with Corbett Keeling.

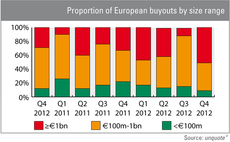

Mega-buyouts bolster Q4 activity figures

The €11.6bn overall enterprise value of Q4’s large-cap deals is the largest total since the third quarter of 2010, which itself was by some margin ahead of every quarter since Q3 2007 (see chart).

unquote" Private Equity Barometer - Q3 2012

Private equity dealflow has remained subdued over the three months to September, with the number of transactions completed plummeting 35% to 182 deals while the aggregated value dipped 14% to €11.7bn.

Q4 Barometer: European deal value up 82%

Q4 Barometer

Q3 Barometer: European deal flow plummets 35%

Q3 Barometer

Unquote" Regional Mid-Market Barometer

The latest unquote" Regional Mid-Market Barometer, produced in association with LDC, shows that mid-cap investors are not letting a lacklustre economy hamper their ability to close deals.

UK Watch: Smaller buyouts still growing

The UKтs smaller buyout space has gone from strength-to-strength in the second quarter of 2012, according to figures in the latest unquoteт UK Watch, in association with Corbett Keeling.

UK: GP confidence wanes

Only 57% of UK-based PE houses expect the British economy to pick up in 2012, according to Investec's latest private equity industry barometer.

Unquote" Regional mid-market barometer

The latest Unquote" Regional mid-market barometer, produced in association with LDC, shows recovery was bolstered by prospering small caps in 2011, with total value of over ТЃ5.4bn across 166 deals.

unquote" UK Watch Q4 2011

The latest unquote" UK Watch, produced in association with Corbett Keeling, reveals Britain has a thriving smaller buyout segment, but at the cost of waning larger deals.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

unquote" private equity barometer - Q4 2011

There was a major drop-off in overall deal volume in Q4 2011, with a continuing contraction across all deal stage segments resulting in a total of just 192 deals, the lowest figure recorded since Q4 1996 (158).

unquote" Private Equity Barometer – Q2 2011

Preliminary figures released today in the Q2 2011 unquote" Private Equity Barometer reveal renewed activity during Q2.

unquote" UK Watch Q1 2011

In the latest edition of the unquote” UK Watch, in association with Corbett Keeling:

Nordic unquote" Private Equity Index

The inaugural Nordic unquote" Private Equity Index, in association with KPMG, shows;

unquote" Regional mid-market barometer

The latest unquote" Regional mid-market barometer, produced in association with LDC, shows both volume and value recovered in 2010 as a whole, with total value of over ТЃ3bn across 161 deals.