Barometer

Q3 Barometer: European PE's strongest third quarter

European market had its most active third quarter on record in 2018 in terms of dealflow

Nordic Fundraising Report 2018

Nordic private equity funds have raised a record amount of money for a calendar year

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Q1 Barometer: Mega-deals propel value to post-crisis record

Deal volume reached the second highest quarterly level in two and a half years, while aggregate value climbed to тЌ54bn

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra тЌ7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

Q4 Barometer: Deal volume and aggregate value slide

Despite a boom in both dealflow and aggregate value across 2017 as a whole, the final quarter of the year saw a slowdown in activity

CEE Fundraising Report 2017

An in-depth statistical analysis of recent fundraising trends in CEE, with insight from local experts, now available to download

Q3 Barometer: Market pauses for breath

European dealflow slows down compared with previous quarter but remains at historically elevated level

Average entry multiple climbs to 10.8x in Q2

Price inflation has led average European multiples to rise further in Q2, according to the latest unquote" and Clearwater Multiples Heatmap

Q2 Barometer: Aggregate PE deal value reaches 10-year peak

Deal numbers climbed for the second consecutive quarter, boosted by buyouts and growth capital deals

Nordic Fundraising Report 2017

The 2017 edition of the unquote" Nordic Fundraising Report delves into detailed statistics of local fundraising and investment trends

Q1 Barometer: Fall in buyouts sees aggregate value drop 30%

Early-stage and expansion deals up, while buyout volumes and values drop

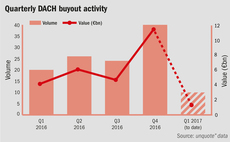

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

Q3 Barometer: Core mid-market buyouts return to growth

Mid-market deal volume across Europe reached its highest total in five quarters

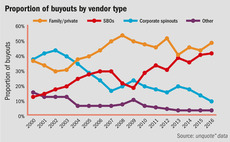

Secondary buyout levels reach new heights

SBO market in Europe has developed steadily over the last 15 years

European entry multiples rebound in Q2

Following a dip in Q1, multiples for European PE-backed buyouts have returned to 2015 levels

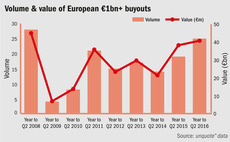

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

Berlin keeps Germany afloat

The German capital has emerged as the lone bright spot in the country, buoying the German private equity industry

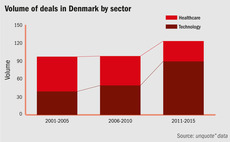

Tech drives Danish PE as healthcare loses ground

Denmark's technology sector has fueled the rise of the local private equity industry

Entry multiples still in double digits for most popular European markets

The latest unquote” and Clearwater International Multiples Heatmap Report, now available for download, neatly reflects the ever-challenging environment for private equity investors.

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014