Barometer

Q4 Barometer: Record value in 2015 despite end-of-year dip

Fewer deals but higher aggregate value in 2015 meant the average deal value jumped by a whopping 53%

Q1 Barometer: deal volume and value decline

The European buyout market witnessed a fall in both deal volume and value for Q1

Strong growth for UK mid-market in 2014 - unquote" barometer

The latest unquote" Regional Mid-Market Barometer highlights strong growth in 2014

Germany, UK drove 10% activity uptick in Q4 2014

Fourth quarter witnessed an encouraging rise in deal volume and value

Q3 Barometer: Mid-market proves resilient

Overall European buyout activity declined, but Q3 figures highlight mid-market's resilience

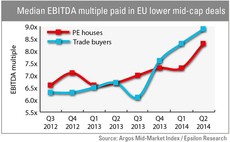

Lower mid-cap valuations near 2006 levels

PE houses catch up with corporates as lower mid-market heats up

Q1 Barometer: primary buyouts stand out

Overall buyouts down by 10% in lacklustre quarter

Last chance to vote: Delphi Nordic Private Equity Survey

Results to be revealed at the Nordic unquote" Private Equity Congress in May

Strong second half boosts UK year-end activity figures

Read the latest unquoteт Regional Mid-market Barometer, published in association with LDC

Q4 Barometer: dealflow bounces back

Following a weak Q3, the final months of 2013 marked the strongest quarter of the year, according to the latest unquoteт Private Equity Barometer, published in association with SL Capital Partners.

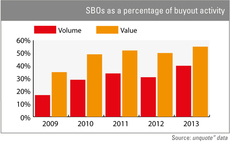

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

UK Watch: 2013 goes out with a bang

A strong final quarter for 2013 saw deal volume and overall value hold up well across the board in the UK, showing a marked improvement on the first quarter of the year, according to the latest unquoteт UK Watch, published in association with Corbett...

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the тЌ75bn mark for the third year in a row, with last year's deals totalling тЌ74.7bn.

Have your say: UK Watch

With 2013 now behind us and market participants gearing up for a busy 2014, where do you see the UK market heading in the coming months?

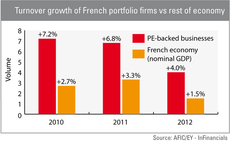

French PE-backed firms outperformed rest of economy in 2012

French private equity-backed companies significantly outperformed their peers in terms of job creation and turnover growth in 2012, according to a new survey by Afic and EY.

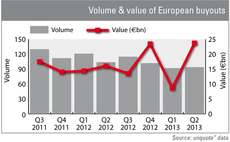

European private equity activity drops to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

Q3 Barometer: European deal volumes drop to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

unquote" Regional Mid-market Barometer

UK mid-market

Early-stage deals further recover in Q2

Both the volume and overall value of early-stage activity registered a welcome uptick across Europe in the second quarter, according to unquote" data.

Germany shifts into overdrive in Q2

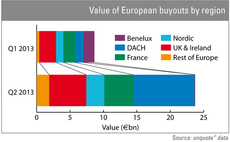

A string of mega-buyouts helped Germany secure the top spot on European buyout value tables in the second quarter of this year.

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

Q2 Barometer: overall value rockets by 175%

Q2 Barometer

Growth capital dealflow ebbs in Q1

Emphasising the pervasive nature of the activity decline in the first quarter of 2013, deal volume in the expansion category recorded a drop commensurate with that of the buyout market.

Q1 Barometer: Deal value hits four-year low

Q1 Barometer