Clearwater

Nordic region sees highest entry multiples for sixth quarter running

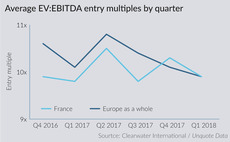

Q2 edition of the Clearwater International Multiples Heatmap finds a slight cooldown across Europe, though the average multiple still exceeds 10x

Horizon acquires EES For Schools

Deal is the second platform investment for the GP's ТЃ200m 2018-vintage vehicle

UK exits on hold in Q1

Exit activity reached its lowest quarterly level since the height of the financial crisis in Q1, according to Unquote Data

LDC sells Away Resorts to Bregal Freshstream

Deal is the 10th investment made by Freshstream's debut fund, which writes cheques of тЌ30-100m

Entry multiples heating up further in Q1 – research

Average value for PE-backed transactions increased by nearly 15% versus Q4 2018, says Clearwater

Cartesian's Arlington Industries secures £95m refinancing

Deal will enable the automotive and aerospace components firm to bolt on Wahler

LDC acquires minority stake in Littlefish

GP has committed to providing the IT consultancy with follow-on funding for acquisitions

TPA Capital acquires Pallet-Track

TPA Capital seeks to invest less then ТЃ25m in businesses with an enterprise value of less than ТЃ50m

Multiples Heatmap: winter cooldown across Europe

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

Multiples Heatmap: DACH deals, mega-buyouts drive inflation

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

LDC exits Prism Medical UK in SBO

Sale ends a four-year holding period for LDC, which acquired Prism from Toronto-based Prism Medical

Ardenton invests in Shaftec Automotive

Deal for the automotive spare parts supplier is the Canadian GP's third UK investment

Palatine acquires CET UK from Dunedin

Acquirer draws capital from its third flagship fund, which typically writes cheques of ТЃ10-30m

Beech Tree invests in BCN Group

GP is currently investing from its ТЃ115m second fund, which invests ТЃ10-40m per deal

Clearwater promotes Loudon to partner

Corporate finance house has made numerous senior appointments since the start of 2018

Beech Tree's Wavenet secures €85m refinancing

Ares and RBS provide a unitranche and super-senior revolving credit facility, respectively

International appetite for Spanish deals soars in H1

Country's dealflow and aggregate value both reached record or near-record levels in H1, with international GP's fueling mid- and large-cap activity

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell

Tech buyouts bolster UK mid-market activity in H1

High multiples in the TMT space have played a part in driving activity in the UK mid-market over the first half of 2018

Entry multiples stay frothy in Nordic region

Valuations in the Nordic countries are notably driven by high-multiple deals in the TMT and business services sectors

Q1 entry multiples drop to lowest level since Q1 2016

PE deal valuations drop for the third consecutive quarter, as the Nordic region continues to see the highest entry multiples

Livingbridge acquires Love Holidays

GP invests in the online travel agent with equity drawn from its ТЃ660m sixth flagship fund

Inflexion invests in management buyout of ITM

GP supports the buyout from the founder-owners of the financial services IT and software firm

Synova generates 8x return on Mandata sale to LDC

Deal for logistics software company brings to an end a five-year holding period for the vendor