CVC Capital Partners

F1 buyout: Gribkowsky sentenced to eight years

Former BayernLB banker Gerhard Gribkowsky has been sentenced to eight years and six months in prison following his trial for corruption, breach of trust and tax evasion.

Gribkowsky admits taking bribes from Ecclestone

Gerhard Gribkowsky has admitted to taking bribes amounting to $44m from F1 chief executive Bernie Ecclestone during the sale of the company to CVC Capital Partners.

Evonik cancels IPO

CVC-backed German chemicals maker Evonik has announced the cancellation of its planned IPO.

CVC further reduces stake in Formula 1

CVC Capital Partners has sold another $500m chunk of its holding in British racing business Formula 1 to Waddell & Reed and Ivy Investment Management.

Market volatility threatens Evonik IPO

The RAG Foundation, which owns a majority stake in CVC-backed German chemicals maker Evonik, could cancel the company's IPO in light of the current market environment.

CVC's Formula One postpones IPO

CEO Bernie Ecclestone told Reuters that the IPO of CVC-backed Formula One Group on the Singapore Stock Exchange may be postponed to later this year.

CVC-backed Evonik announces IPO

CVC Capital Partners-backed German chemicals maker, Evonik Industries, has confirmed plans to float in the Prime Standard segment of the Frankfurt stock exchange.

CVC Capital Partners said to raise €10.75bn fund

CVC Capital Partners is in the process of raising a new Europe-focused fund targeting €10.75bn ($13.5bn), reports suggest.

CVC reduces stake in F1 prior to IPO

CVC Capital Partners has sold a $1.6bn stake in Formula 1 Group to BlackRock, Waddell & Reed and Norges Bank Investment Management prior to the company's IPO, according to reports.

CVC acquires AlixPartners

CVC Capital Partners has acquired a majority stake in corporate advisory firm AlixPartners from private equity owner Hellman & Friedman.

CVC to buy AlixPartners

CVC Capital Partners is to buy restructuring and consulting firm AlixPartners from private equity owner Hellman & Friedman for more than $1bn, according to reports.

CVC Credit Partners appoints Hickey as partner and CRO

CVC Credit Partners has hired Stephen Hickey as partner, chief risk officer and member of the management committee.

CEE activity: bottomed out?

Next weekтs CEE unquoteт Congress will reveal reader sentiment for CEE prospects.

Lenders urge GPs to talk about refinancing

The well-documented 2014 “wall of debt” is pushing many GPs down the refinancing route. Easier said than done given the current lending climate – but early birds could stand a better chance of catching the proverbial worm. Greg Gille reports

CVC exits StarBev in €2.65bn trade sale

CVC Capital Partners has sold CEE-focused brewer StarBev to NYSE-listed Molson Coors Brewing Company for €2.65bn.

CVC to refinance Formula One Group

CVC has launched a process to refinance portfolio company the Formula One Group.

Ex-PAI keyman joins CVC

CVC Capital Partners has hired Bertrand Meunier, the former partner committee chairman at PAI Partners, as managing partner and member of the PE board.

CVC & Vista head-to-head on Misys bid

Another bidder for FTSE 250 banking software company Misys has dropped out, leaving two private equity bidders in the race.

CVC and ValueAct approach Misys

CVC Capital Partners and ValueAct Capital Master Fund, the largest shareholder in Misys, are said to be considering a joint cash offer for listed software business Misys.

Cinven and Goldman ready to sell Ahlsell to CVC

Cinven and Goldman Sachs Capital Partners are set to sell Swedish tool supplier Ahlsell to CVC Capital Partners.

CVC and Nordic Capital's LEAF in reverse takeover with Cloetta

CVC Capital Partners and Nordic Capital have exited portfolio company LEAF to listed trade player Cloetta in a reverse takeover.

Apollo acquires Taminco for €1.1bn

Apollo Global Management has acquired chemical company Taminco from CVC for about €1.2bn.

CVC Capital Partners exits Dutch retailer

CVC Capital Parnets has sold Dutch supermarket chain C1000 to retail group Jumbo.

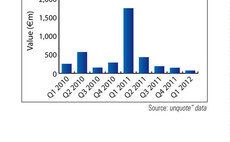

Buyout activity slumps in Q4

While the dip in European buyout activity was not as sharp as expected in the third quarter, dealflow has since then slowed down considerably – leaving little hope for an uptick on 2010’s year-end figures. Greg Gille reports