CVC Capital Partners

PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

German private equity's 2012 highlights

2012 in review: Germany

CVC buys Cerved from Bain Capital and Clessidra for €1.13bn

CVC Capital Partners has acquired Italian business intelligence provider Cerved from Bain Capital and Clessidra for €1.13bn.

British PE firms circle Italy's Cerved

CVC and Permira have shown an interest in acquiring Milan-based corporate intelligence and rating agency Cerved, according to reports.

CVC and Charterhouse mull Ista exit

CVC and Charterhouse have hired Deutsche Bank and Goldman Sachs to advise on the sale of German utilities metering firm Ista, according to reports.

Nordic PE investment fell in Q3

Private equity funds invested around тЌ1.1bn in the Nordics in the third quarter, тЌ750m less than in Q2, according to the Argentum Q3 2012 Report. The figures paint Q3 as the trough for the region this year.

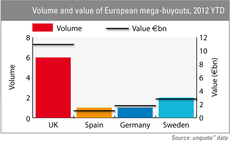

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Top 5 largest funds of all time

Last week, Advent International raised one of the biggest private equity funds investing in Europe in recent years, but how does it compare with the largest funds of all time?

Charterhouse to sell Ista

Charterhouse Capital Partners and CVC Capital Partners are looking to sell German energy-metering business Ista International for more than €3bn, having already attracted staple financing offers of €2bn from banks, according to reports.

Apollo officially launches new $12bn fund

Global private equity house Apollo Global Management has started marketing its eighth buyout fund with a $12bn target, co-founder Josh Harris announced during a presentation at the Bank of America Merrill Lynch Banking and Financial Services conference...

PE-backed Cortefiel refinances €1.3bn debt

Spanish clothing retailer Cortefiel, backed by CVC, Permira and PAI partners, has refinanced €1.3bn worth of debt, according to reports in the Spanish press.

Michael Smith set to retire as CVC chairman

Michael Smith will retire in January 2013, leaving the chairmanship of CVC Capital Partners to Donald Mackenzie, Rolly van Rappard and Steve Koltes.

Permira and AMG bid against Orix in Robeco sale

Only Permira, AMG and Japanese financial services group Orix are left in the bidding war for Rabobank's asset management unit Robeco, reports in the local press suggest.

The Southern European renaissance

After a bleary-eyed summer, Southern European deal activity awoke last month with a notable increase in both volume and value.

KKR, CVC, Carlyle and Apax looking into bid for Urenco

Four of the world's largest private equity houses are thought to be considering bidding for British nuclear fuel provider Urenco, according to The Sunday Times.

CVC appoints James Schiro to advisory boards

CVC Capital Partners has appointed James Schiro as senior adviser to its US and global financial institutions advisory boards.

CVC and Cinven cash in on Smurfit Kappa

CVC Capital Partners and Cinven have divested half of their 8% stake in Irish packaging company Smurfit Kappa, reaping around тЌ80m.

Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.

Sovereign wealth funds buy 10% of CVC

Three sovereign wealth funds - two Asian and one Middle-Eastern - have bought a combined 10% stake in CVC Capital Partners' management company, according to reports.

Top 5 exits of 2012 so far

Top 5 exits of 2012

Seat Pagine Gialle in €1.3bn debt-for-equity swap

Seat Pagine Gialle, the Italian directories firm backed by CVC Capital Partners, Permira and Investitori Associati, has announced the conversion of a tranche of bonds to equity.

Takeover rumours send M&S shares soaring

CVC Capital Partners has emerged as a suitor for listed UK-based retailer Marks & Spencer (M&S), with rumours of a potential take-private sending the company's share price soaring on Friday.

Top 5 buyouts of 2012 so far

Top 5 buyouts

Apax, CVC, Carlyle and Trilantic bid for Euskaltel

Apax Partners, CVC Capital Partners, Carlyle and Trilantic are the final four bidders for 49% of Spanish telecommunications company Euskaltel, according to reports in the Spanish press.