Exclusive

EMZ acquires FotoFinder Systems

EMZ is acquiring a majority stake in the medical imaging company via EMZ 9, which is 80% deployed

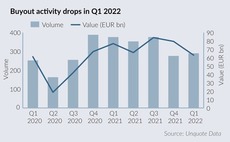

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

SEB Private Equity sells Norcospectra to Accent

Commercial interiors business is expected to expand via add-ons and develop its digital offering

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

H2 Equity exits premium logistics group Cadogan Tate to TSG

US sponsor plans to use acquisitions to expand the London-headquartered company abroad; management will retain minority stake

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

JamJar closes second fund on GBP 100m

JamJar Fund II is the consumer technology-focused first fund with institutional investor backing

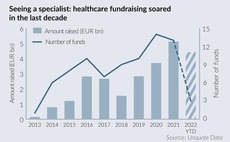

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Access holds EUR 375m first close for ninth flagship fund

Managing partner Philippe Poggioli speaks to Unquote about the Access Capital Partners' small-cap buyout fund-of-funds strategy and the GP's latest fundraise

Nordwind reaches first close for debut technology fund

GP has been making technology investments deal-by-deal since 2012 and is now raising a EUR 160m fund

NorthEdge appoints two new partners amid several senior promotions

UK GP bolsters teams in Manchester, Leeds and Birmingham with 80% of Fund III to invest and over 50% of its SME vehicle deployed

Ufenau VII closes on EUR 1bn hard-cap

Switzerland-based buy-and-build specialist plans to make 13-15 platform deals from the fund

Lightrock announces promotions, board appointments

Impact investor expects to turn its focus to new deals in 2022 and grew its team by 30% in 2021

Hg invests in EQT, TA backed IFS and WorkWave

EQT VIII exits majority of its positions and reaps 3x money after two years invested in the cloud software companies

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

Summit buys 18 Week Support

Deal for UK-based NHS insourcer confirmed by March 25 Companies House filing; buyout follows Houlihan Lokey-led auction launched last year

Growth Capital Partners V holds GBP 260m final close

UK-based GP aims to provide flexible capital for UK-based technology, services and industrials SMEs

GP Profile: Patrimonium Private Equity aims for full fund deployment and add-ons in 2022

Swiss sponsor has EUR 150m in fund commitments and expects two to three more platform deals this year

Summa co-invests in Castik-backed TBAuctions

Summa joins as shareholder after financing three Nordics-based bolt-ons for the online auctions platform

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

Palatine buys significant minority stake in Cura Terrae

GP becomes the single largest shareholder in the newly created UK-based environmental services group

Apax leads GBP 175m round for ClearBank

Clearing and embedded banking platform is the first deal from the GPтs USD 1.75bn Apax Digital II

Clearlake, Motive to acquire BETA+ from LSEG for USD 1.1bn

GPs will use wealth management processing solutions provider as a buy-and-build platform and enter new high growth markets