Exclusive

VC Profile: CapitalT

Co-founder Janneke Niessen talks to Unquote about the firm's fundraise and its data-driven model to analyse startup teams

CapitalT holds first close for debut fund

VC firm was founded by Janneke Niessen and Eva de Mol, and will target €40m for its first vehicle

2020 Outlook: Southern Europe finishes 2010s on record high

Deal volume was the highest on record in 2019 with 174 buyouts, though aggregate value decreased to €25bn from €30bn

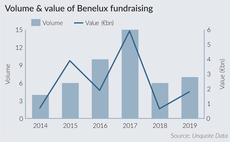

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Unquote Private Equity Podcast: DACH fundraising special

The Unquote Private Equity Podcast hosts Paul Tilt and Harriet Matthews to discuss the findings of the latest DACH Fundraising Report

DACH Fundraising Report 2020

DACH private equity fundraising was in rude health in 2019, with 26 funds securing a combined €13bn across all strategies for the region

Vertis to launch €120m fifth VC scaleup fund

Fund will target companies with revenues of at least €5m, operating in a wide range of innovative sectors

Amundi PEF, SGCP back Vivalto Vie in capital reshuffle

Azulis Capital exits the care home operator, having backed it since 2015

Q4 Barometer: Continued buyout bonanza tops record-breaking year

Private equity investors completed 807 deals in Q4 2019, tipping the year into record-breaking territory

NB Renaissance Partners III close to hitting €1bn target

Fund acquires majority stakes in Italian mid-market companies operating in a wide range of sectors

August Equity Partners V closes on £300m, acquires Air IT

Fund held a first close in December 2019 on almost ТЃ200m and closed on its hard-cap of ТЃ300m

Nexxus Iberia buys Grupo Bienzobas

Fifth investment made by the GP via its first Spanish fund, Nexxus Iberia Private Equity Fund I

Nexxus Iberia closes first Spanish fund on €170m

Fund targets investments in Spanish companies with potential to be expanded into Mexico and the US

2020 Outlook: DACH buyout volume stalls amid macro uncertainty

Overall dealflow plateaued, with just one buyout more recorded in 2019 compared with 2018

Women Equity Partners launches debut fund

Fund will follow a data-backed investment strategy, targeting women-led SMEs in France

IPEM TV 2020: direct investing still tricky, says Coller's Francois Aguerre

Aguerre explains why co-investments will likely remain a preferable option for large LPs

2020 Outlook: Tech deals boom while fundraising flourishes in France

Local GPs look forward to another busy year and hope to build on the record dealflow seen in 2019

INVL closes Baltic Sea Growth Fund on €165m

Fund's predecessor, Invalda INVL, recorded an average 27% gross IRR and 2.4x money

Unquote Private Equity Podcast: IPEM Highlights

The Unquote Private Equity Podcast recaps key takeaways from exclusive interviews with a number of speakers and delegates

GPF Capital closes third buyout fund on €300m

Fund targets SMEs operating in a wide range of sectors and generating EBITDA in excess of €3m

Amundi PEF nears first close for Megatendances II fund

Megatendances II is being marketed to both retail and institutional investors

2020 Outlook: Political change heralds UK buyout revival

Deal volume was down last year, but record-high value and a more settled political backdrop mean 2020 could be busy for the UK

GreyBella Capital to launch new fund by mid-2020

Fund targets series-A and -B rounds in companies operating in life sciences and complex technologies

Metrika launches €150m maiden fund

Vehicle targets majority and controlling minority stakes in export-orientated Italian companies