Exclusive

PAI Partners to launch €600m mid-market fund

Vehicle will target companies based across Italy, Spain, Germany, France and the Benelux region

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

415 Capital holds first close for maiden fund

Medtech-focused VC fund will target startups involved in the treatment of cardiovascular diseases

Pantheon Global Secondary Fund VI to close in 2020

Pantheon's latest vehicle, Global Secondary Fund VI, is expected to hold a final close in 2020, Unquote understands.

Portobello Capital launches €300m minority-focused fund

Portobello Structured Partnership I will target minority stakes in mid-market companies

Heal Capital launches first fund, hires Weiß as partner

Berlin-based VC has received €80m in commitments and will focus on technology-enabled healthcare

Mirabaud launches second PE fund

Fund will target sustainable investments and new technology in lifestyle-focused businesses

Abac Capital targets €350m for second fund

Fundraising activity is expected to flourish in 2020, with numerous GPs wrapping up their funds

BPE holds first close for BPE 4 on €122m

Germany-based, MBI-focused vehicle is targeting a final close on its €135m hard-cap in Q1 2020

Alto Partners exits Artebianca to trade

Alto is currently investing its fourth fund, which closed on its €210m hard-cap in April 2018

Mandarin's Neronobile acquires Daroma

Mandarin intends to further expand the business and create a platform across the Italian coffee sector

Corporate divestments fuel European buyouts

Carve-outs and spin-outs represented around 14% of all buyouts in 2019, up from 11.5% in 2018 and 10% in 2017, according to Unquote Data

Model LPA – useful protection or unnecessary guide?

Fund formation specialists weigh in on ILPA's recently launched Model Limited Partnership Agreement

PAI's Meyer-Schönherr steps down

Meyer-Schönherr's responsibilities will be taken over by Andreas Kumeth and Philipp Meyer

Meridia Capital to launch €150m second fund

Fund will target majority and minority stakes in Spanish companies generating revenues of €15-150m

Elysian to launch new £250m fund in Q1 2020

Current fund also closed on ТЃ250m, in 2015, and is nearly three-quarters deployed

Magnum back on the road for third fund

GP is looking to raise €400-450m from institutional investors for Magnum Capital III

Slingshot Ventures aims to raise up to €100m in 2020

VC will consider breaking with tradition with a separate institutional fund of up to €40m

PAI completes GP-led secondaries deal for Fund V

Alpinvest, Goldman Sachs and HarbourVest are lead investors in the new fund

Mandarin holds €173m interim close for third fund

MCP III has a €250m target and invests in export-orientated companies with EVs of €30-70m

Truffle Capital collects €390m across two venture funds

GP raises sector-specific funds, while it previously managed generalist vehicles

Luxembourg's IFMs keep up with tech

Luxembourg and its myriad local administrators are working hard to adapt to the technology-driven shake-up of the fund admin space

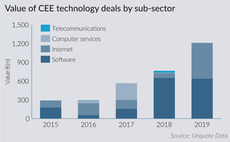

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Made in Italy Fund holds €150m interim close

Fund is managed by Italian GP Quadrivio in partnership with Pambianco Strategie d'Impresa