Finland

Sitra invests in Savosolar

Sitra has invested in Finnish manufacturer of solar thermal solutions Savosolar Oy.

Sentica takes 75% Kotipizza stake

Sentica Partners has acquired 75% of Finnish restaurants group Kotipizza.

Nordic unquote" out now

The latest digital edition of Nordic unquoteт is out now, featuring all the latest analysis, deals and exits in the region.

Nordic unquote" September 2011

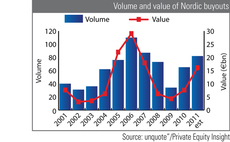

Buyout activity in the Nordics could return to levels seen pre-credit crunch, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to almost reach 2007 levels, marking...

FII and Etera invest in Academica

Finnish Industry Investment (FII) and Etera Mutual Pension Insurance Company have invested in Finnish ICT service provider Academica.

Nordic buyouts set to return to 2007 levels

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Sponsor Capital et al. sell Lujapalvelut

Sponsor Capital, Varma and other shareholders have sold Finnish facility management company Lujapalvelut Oy to Coor Service Management.

FII et al. invest €2m in Multitouch

Finnish Industry Investment (FII) and Veritas Pension Insurance have invested тЌ2m in Finnish interactive display developer Multitouch Ltd.

Valedo acquires Corbel from Sentica

Valedo Partners has acquired real estate management services provider Corbel Oy from Sentica Partners.

Litorina-backed Semantix acquires Done Information

Litorinaтs portfolio company Semantix has acquired Finnish-based translation service provider Done Information Oy for тЌ2.5m.

Nordic unquote" July/August 2011

Just a few months after closing what many call Europeтs most impressive fund of the year, Montagu is waving goodbye to two directors, unquoteт has learned from sources close to the fund.

Nordic private equity shines in Q2

The Nordic market is back in full swing, according to figures from the latest Nordic unquote" Private Equity Index, published in association with KPMG.

Nordic unquote" Private Equity Index Q2 2011

In the latest edition of Nordic unquoteт Private Equity Index, in association with KPMG.

Ghosh joins GE Capital leverage team

GE Capital has appointed Amitav Ghosh to its European leveraged finance team. He joins the firm as executive director.

CapMan's Eastway merges with AVAB CAC

CapManтs portfolio company Eastway has merged with Norwegian AVAB CAC AS and AVAB CAC Bergen AS.

Sentica-backed MediaPex acquires Suomen Telecenter

Sentica Partners has acquired Suomen Telecenter Oy as an add-on for portfolio company MediaPex Oy.

LSP et al. invest €8.1m in Mendor

A consortium, consisting of Life Sciences Partners (LSP), Finnish entrepreneur Risto Siilasmaa, Finnish Industry Investment, Ilmarinen Mutual Pension Insurance Company, Biothom and Finnvera Venture Capital, has participated in a тЌ8.1m series-B funding...

IK-owned Moventas files for bankruptcy

IK Investment Partners' portfolio company Moventas Oy, a Finnish manufacturer of gears for wind turbines, has filed for bankruptcy.

Nordic and Deutsche unquote" out now

The latest digital editions of Nordic unquote” and Deutsche unquote" are out now, featuring all the latest analysis, deals and exits in these regions.

Nordic unquote" June 2011

Private equity firms are looking to exit a large number of their portfolio companies in the coming 12 months, according to Grant Thornton UKтs latest Private Equity Barometer.

Sentica acquires stake in Citec

Sentica Partners has acquired a 67% stake in multi-discipline technical solutions and project services provider Citec Group.

Discipline key to success in Nordics

тThe mid-market has been remarkably well disciplined in the last couple of years in the Nordics,т Gustav Bard, MD of 3i Nordics said this morning in Stockholm. тSuch restraint will help make this a very good vintage,т he continued, speaking at the seventh...

Accel et al. invest $12m in Supercell

Accel Partners, alongside existing investor London Venture Partners and Klaas Kersting, has invested $12m in Finnish game developer Supercell.